- Index funds can provide a straightforward alignment with many clients’ investment goals, especially for those with a long-term horizon.

- When pursuing exposure to a specific market segment, investors typically choose between active or index funds, weighing the potential benefits of each approach.

- The key reasons to consider index funds include predictable relative performance, diversification, low costs and the investment discipline they can foster.

While it’s been nearly 50 years1 since Vanguard launched the world’s first index fund for individual investors, the index-based approach to investing continues to grow in popularity. Indeed, we have also seen interest in index-tracking ETFs rise sharply in the past decade. When investors are looking to access a particular market segment, many will look to either index or active funds for specific exposures. Here we discuss the four main reasons why clients might choose an index fund, which are drawn from our new paper, Considerations for index fund investing.

1. Predictability of relative returns

The decision to invest in an index fund typically stems from a desire for relative return predictability2. Index fund investing seeks to minimise variation from the benchmark, which contrasts with the goal of active funds to outperform their benchmark.

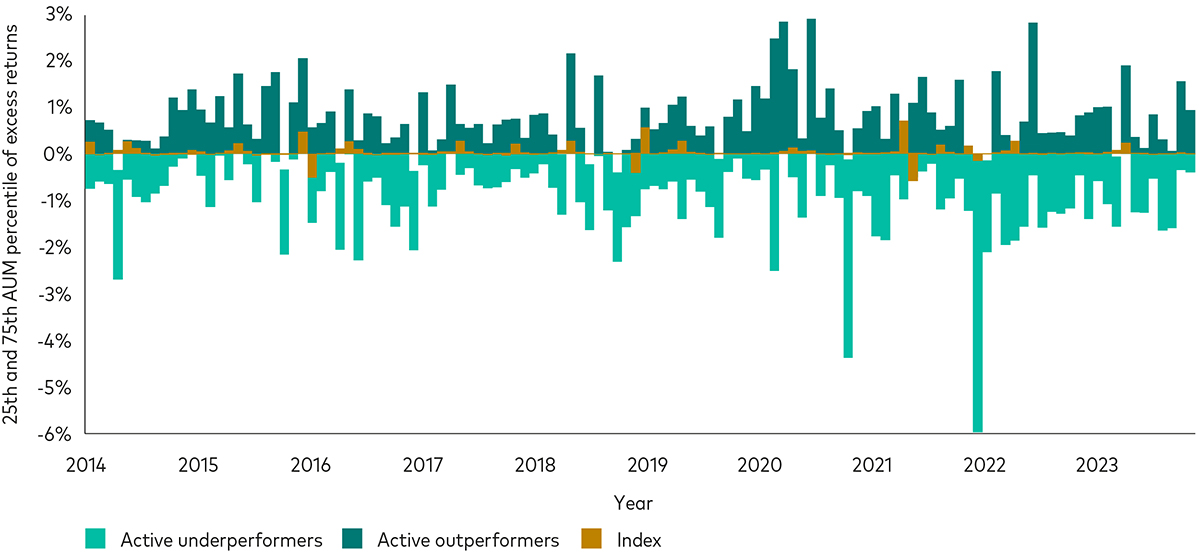

As we can see in the chart below, index funds have achieved greater relative performance predictability than active funds. The range of outcomes experienced by investors in active equity funds is much wider than that of index funds. While the fraction of actively managed assets outperforming the benchmark varies from month to month, the monthly performance is widely dispersed around the benchmark with the average index and active fund slightly underperforming the benchmark after fees.

Index fund performance is concentrated in a narrow band around the benchmark. Therefore, an investor looking for relative performance predictability in a market segment can achieve that objective with minimal further oversight in an index fund3.

Index fund investing exhibits greater relative performance predictability

Active funds experience a wider range of outcomes

Note: The chart displays the AUM-weighted interquartile range (25th to 75th percentile) of excess returns (in Swiss francs, net of fees with income reinvested) of active and index European equity funds available for sale in Switzerland relative to their primary prospectus benchmark for the 10-year period ending 31 December 2023.

Sources: Vanguard calculations, using data from Morningstar.

2. Provide balance by diversifying across the entire market segment

If an investor’s goal is to replicate rather than outperform the returns of a market segment, the best way to achieve this is by investing in the broadest market cap-weighted strategy that most closely resembles the overall market segment – typically a broad market index fund.

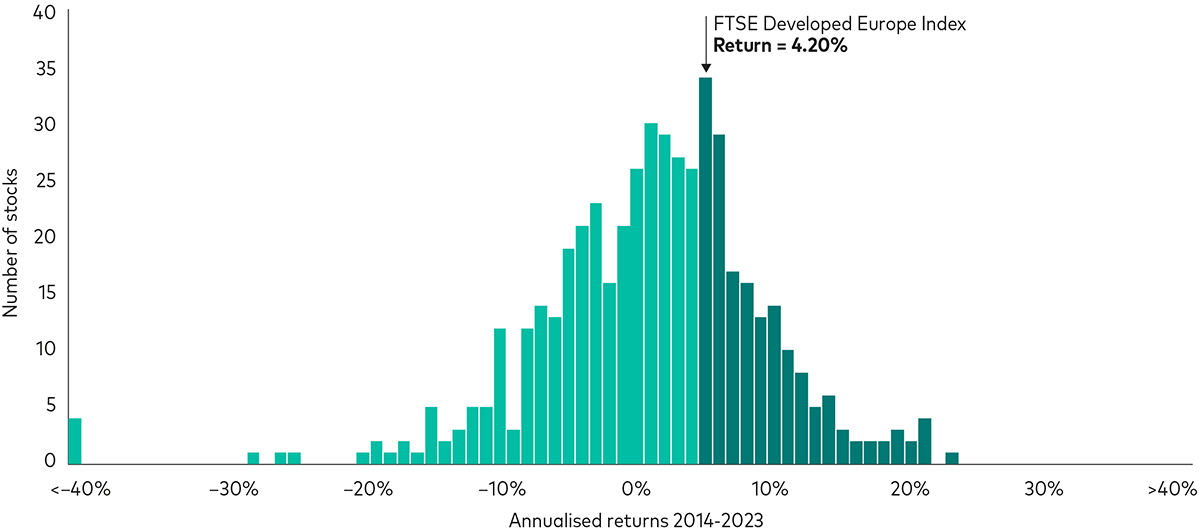

The importance of broad diversification is further underscored by comparing the long-term performance of securities in a benchmark index against the aggregate index performance.

The chart below shows the performance of constituent stocks in the performance of constituent stocks in the FTSE Developed Europe Index (in Swiss francs) from 2014 to 2023; significantly less than half of all stocks (39%) outperform the benchmark. Unless investors have high conviction for a well performing, actively managed strategy, beating the index return with a subset of stocks is challenging. During this period, the FTSE Developed Europe Index produced a return of 4.20% which beat both the mean (1.21%) and median (2.15%) return of individual stocks in the index.

By owning a broad-based index fund that holds as many securities in that segment as possible, investors capture the closest exposure possible to a market segment.

The fear of missing out is real

Broad-market index investing diversifies opportunities

Notes: Chart shows the distribution of annualised returns for stock constituents of the FTSE Developed Europe Index (in Swiss francs, net of fees) as of January 2014. Performance is presented for the period 1 January 2014 through 31 December 2023 with reinvestment of all dividends. Overlaid is the total return performance of the FTSE Developed Europe Index over the same period.

Source: Vanguard calculations, using data from Morningstar.

3. Minimise costs – an enduring determinant of performance

Investors are subject to costs including, but not limited to, expense ratios, transaction costs and, where applicable, taxes – all of which can be a significant drag on net4 returns over time.

After deducting expense ratios, actively managed funds exhibit a bell curve of returns spread over a wider range of performance when compared with index funds. This highlights the higher relative performance predictability of index funds as well as the opportunity for outperformance and risk of underperformance associated with active funds.

Index funds have a much narrower range. The combination of relative performance predictability (due to their close tracking of the benchmark index) and lower costs results in performance close to that of the target benchmark index. In addition, we know that for both index and active funds, higher fees do not result in higher excess returns.

4. Instilling discipline to help investors achieve investment success

If an investor has identified a low-cost index fund that closely tracks the desired market segment, the fund can be held for the long term (or until their goals change). This simplicity can help to encourage sound investing discipline.

Building discipline into an investment plan is important, as many investors react to past fund performance. Data have shown that investors often react to the past performance of funds (as measured by cashflows), with outflows following negative returns and inflows following positive returns. This reactive behaviour is more than twice as strong in active fund investors5 as it is for index fund investors over multiple short-term horizons.

Index fund investing does require that investors maintain discipline with their investment strategy. Timing exposure to an index fund with the hope of outperforming the market segment can be a tempting deviation from investment goals that often leads to underperformance. For example, our analysis shows that investors who sell their position in the MSCI World Index the day after a 5% drawdown6 (or 10%, 20% drawdown) experience a significant drag on their long-term performance.

We believe that having the discipline to stick with investment decisions is a product of two things: the rigour of the investor’s decision process itself and their conviction7 that it generates in their ability to successfully navigate market environments over their investment horizon. The path to investment success is bumpy and can be paved with periods of deep and prolonged negative returns. But for those investors with conviction in their investment plan and a willingness to endure the associated risks, index fund investing plays an important role in a well-designed investment plan.

To find out more, read the new Considerations for index fund investing research report.

1 Vanguard launched the first index fund available to individual US investors on 31 August 1976.

2 All investing is subject to risk. Relative return predictability refers to the ability or goal of an index fund to track a benchmark and thus be predictable with regard to the expectation of return for the benchmark, not to the frequency or magnitude of positive or negative returns. This can be thought of as market (systematic) risk. Active funds’ goal of outperforming a stated benchmark implies greater variability of returns around that of the benchmark and results in active (idiosyncratic) risk, which can be thought of as additive with regard to market (systematic) risk.

3 Technically, because an investor or fund manager cannot invest directly in a benchmark, an index fund possesses implementation costs and frictions such as expense ratios and transaction costs, as indicated by the dark yellow bars in Figure 2. For certain indices where the index pricing and fund NAVs are calculated at different times of the day, the closing value of the index may temporarily deviate from the fund price, resulting in offsetting excess returns.

4 “Net” refers to performance after costs are considered. All charts here refer to net performance unless otherwise noted.

5 The desire to make changes can be particularly problematic for active fund investors. Tidmore and Hon (2021) estimate that more than half of funds outperforming over a 10-year period experienced a drawdown that lasts for up to four years. Many investors lack the necessary patience to thrive in an active fund, making the simplicity of index investing more appealing.

6 We define a “drawdown” as the cumulative underperformance from the previous peak value of the index.

7 For further discussion of the incorporation of conviction in investment and portfolio decisions, please see Black and Litterman (1992).

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in EEA by Vanguard Group Europe Gmbh, which is regulated in Germany by BaFin.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.

© 2024 Vanguard Group Europe Gmbh. All rights reserved.