- We expect a supportive environment for fixed income investors over the next decade – but periodic volatility is likely to persist in the near term.

- To better equip investors with the tools they need to navigate evolving markets, we have enhanced our range of fixed income ETFs.

- These new ETFs span global government bonds and short-duration euro corporate and euro government bonds, providing core building blocks to target specific fixed income exposures for portfolios.

Our research suggests a supportive environment for fixed income investors in the coming years. Although central banks are now easing monetary policy, we still expect interest rates to settle at higher levels than we saw in the 2010s. This backdrop sets the foundation for solid bond returns.

Our equity view, however, is more cautious. The key tension in risk assets is between momentum and overvaluation. US equities, and technology stocks in particular, are priced for perfection and potentially susceptible to any adverse surprises. This market dynamic, coupled with heightened policy risks, has led to a series of bouts of volatility to start the year.

To give investors the tools necessary to build portfolios for the long term while navigating near-term volatility, we have enhanced our fixed income ETF offering with three new exposures:

These diversified portfolio building blocks can provide the solutions investors need to target specific bond exposures. Here we outline how these fixed income building blocks can help investors to refine their portfolios.

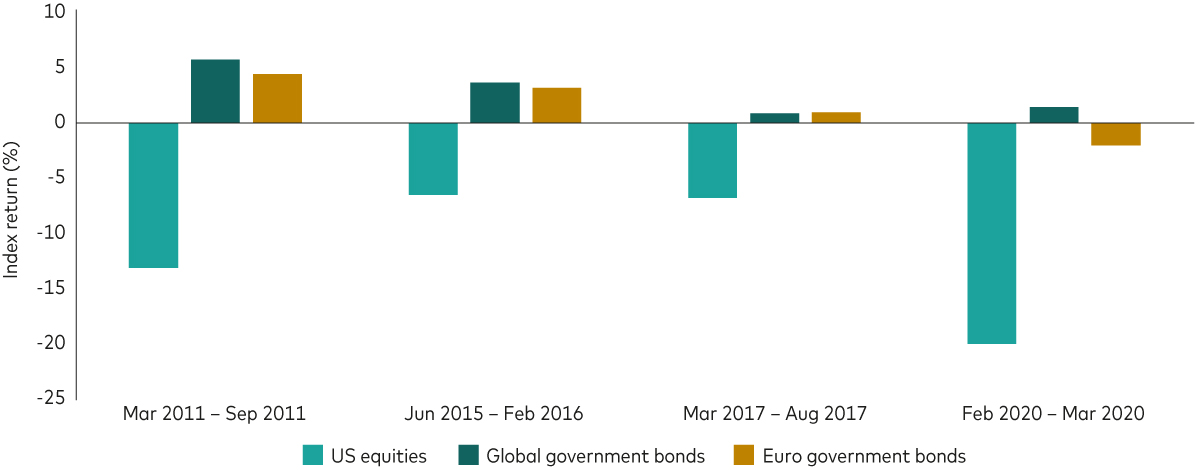

Global government bonds can dampen risk of equity market drawdowns

The broad diversification of the global government bond universe is particularly relevant in today’s markets. From a correlation perspective, a core global government bond exposure can allow investors to brace portfolios against equity market volatility.

For example, euro-denominated government bonds have a correlation of 0.16 to the flagship US equity benchmark the S&P 500 index1. But with global government bonds, the correlation to the S&P 500 approaches zero (0.02)2. We observe this lower sensitivity to equity market moves because the global government bond exposure contains US government bonds, or Treasuries, which continue to be seen as a refuge when investors seek safe-haven assets.

Historically, looking back at major equity market sell-offs, we can see how global government bonds have provided both enhanced risk-dampening properties in addition to, in most cases, a slightly higher return relative to euro government bonds.

Global diversification as an effective risk-dampener

Returns experienced during past periods of equity market sell-offs

Past performance is not a reliable indicator for future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Vanguard. Reference indices – equities: S&P 500, global government bonds: Bloomberg Global Treasuries Developed Countries Float-Adjusted Index Hedged EUR, euro government bonds: Bloomberg Global Aggregate EUR Government Float Adjusted Total Return Index Hedged EUR. Returns are in local currency as noted and include the reinvestment of income.

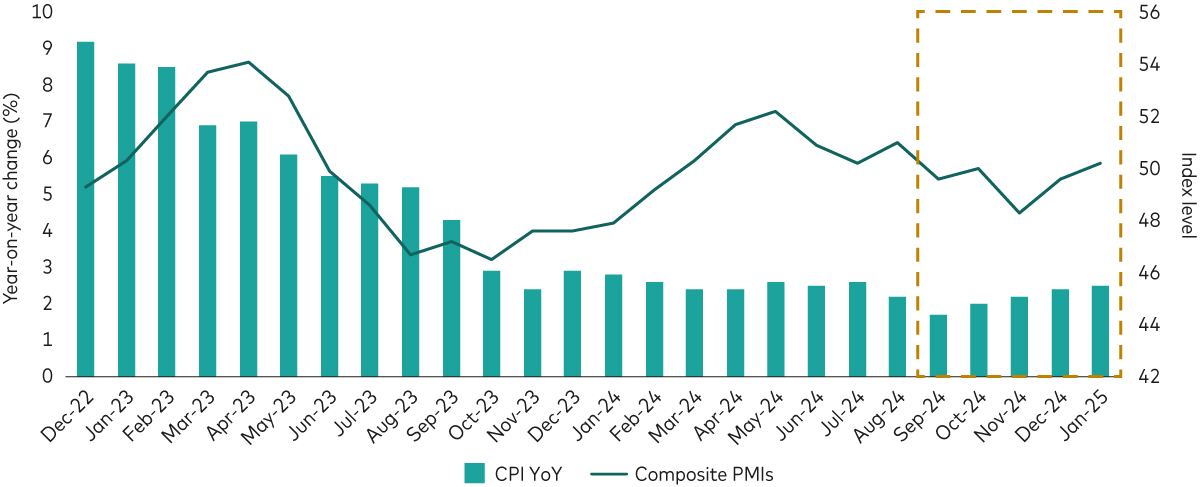

Hedge uncertainty with short-duration euro government bonds

For investors who might be seeking more targeted exposure, short-duration bonds—which are less sensitive to changes in interest rates than their longer-duration equivalents—can offer a valuable complement to portfolios. How can short-duration euro government bond exposures3 enhance portfolios in the current environment?

The European Central Bank (ECB) has been cutting rates and, in general, we have seen economic data trend downwards over the past two years, with lower inflation and pockets of slower growth. However, recent developments have increased the risk to this view and markets are now expecting the ECB to take a more hawkish stance, as increased spending plans could give a boost to economic growth.

In such times of volatility, a short-duration exposure can provide investors with a portfolio hedge. Indeed, during the past few months both year-on-year consumer price index (CPI) and composite purchasing managers index (PMI) readings have ticked upwards, as the chart below illustrates, and we have also seen yields in the last few weeks shift higher due to increased spending plans by the German government.

Potential for short-term volatility in economic data

Changes in the data could mean rate cuts don’t arrive as expected

Source: Bloomberg. Lefthand side: Eurostat Eurozone Core MUICP (Monetary Union Index of Consumer Prices) YoY NSA, data from 31 December 2022 to 31 January 2025. Righthand side: HCOB (Hamburg Commercial Bank) Eurozone Composite PMI SA, data from 30 September 2024 to 31 January 2025.

Over this time, investors would have been better off (from a return and volatility perspective) in a 1-3 year euro government bond exposure compared with the full-duration exposure. So for investors who are exploring ways to guard against short-term interest rate volatility, adding short-duration euro government exposure could be an effective way to position portfolios.

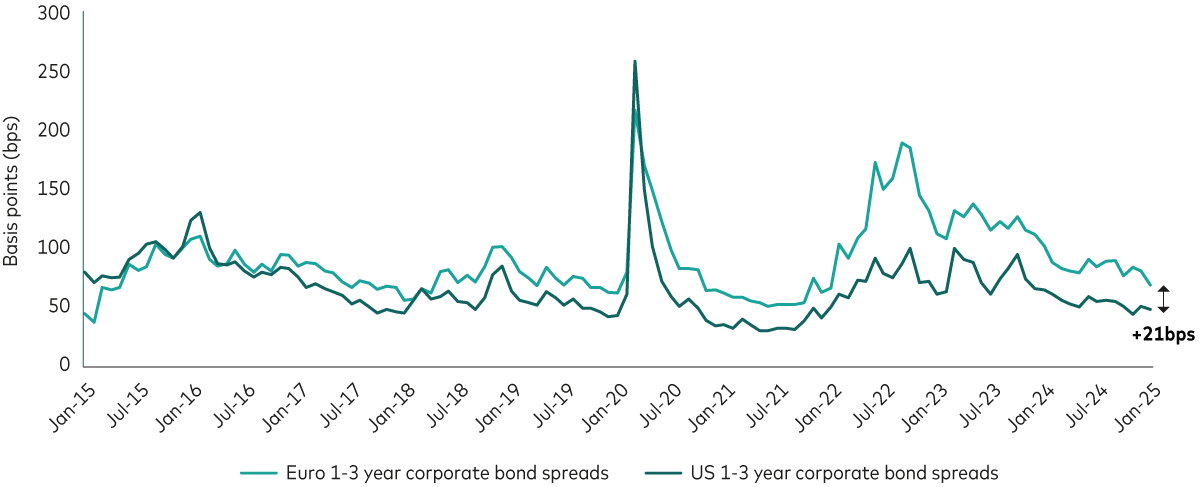

Capturing the carry with short-duration euro corporates

For investors looking to enhance the yield in their portfolios, short-duration euro corporate bond exposures4 can be a useful tool. As the chart below shows, short-duration euro corporate bonds continue to offer a higher spread over the risk-free rate than equivalent US short-duration corporate exposures5. This spread pick-up is even more attractive compared with the full-duration universe, which has seen significant spread compression overall. Euro short-duration corporates offer more attractive valuations, for the same sound fundamentals.

Euro corporates offer attractive yield

Short-duration euro corporates provide a higher spread versus US

Past performance is not a reliable indicator for future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Source: Vanguard. Data as at 31 January 2025. Reference indices are the Bloomberg Euro Corporate 500 1-3Y Index average option-adjusted spread and the Bloomberg US Corporate 1-3 Yr Index average option-adjusted spread.

Short-duration euro corporate bond exposures also offer a compelling proposition from a diversification perspective. We’ve seen a sharp rise in the number of companies issuing short-dated corporate bonds over the past decade. As of January 2025, the Bloomberg Euro Corporate 500 1-3Y Index has more than 500 issuers, with no issuer in the top 10 making up more than 2% of the index. Therefore, the performance of the index will tend to be less influenced by the bond issues of any one company than an index comprising fewer constituents.

When considering short-duration bond exposure, investors should also understand the longer-term implications – particularly with respect to the power of compounding6. One of the ways that short-duration bonds differ from cash is from a total return perspective, as bonds offer the potential for price appreciation, which cash does not. Investors should not underestimate the power of compounding when analysing how this type of fixed income exposure can complement a portfolio over time.

Learn more about Vanguard’s new fixed income ETFs

Please visit our launch page to learn more about the new ETFs and how they can fit into portfolios. If you would like to learn more about Vanguard’s ETF offering more generally, we invite you to visit our capabilities page.

1 Reference indices are the Bloomberg EUR Government Float Adjusted Total Return Index Hedged EUR. In the context of equity and bond markets, a lower correlation means that the movements of the two asset classes are less closely related to each other. Source: Vanguard using Bloomberg data, as at 31 January 2025.

2 Reference index is the Bloomberg Global Treasuries Developed Countries Float-Adjusted Index Hedged EUR.

3 Reference index is the Bloomberg Euro Aggregate Treasury 1-3Y Index.

4 Reference index is the Bloomberg Euro Corporate 500 1-3Y Index.

5 The “risk-free rate” is the theoretical rate of return of an investment that carries zero risk.

6 In the context of investing, “compounding” refers to the process where the value of an investment grows exponentially over time because the earnings are reinvested to generate additional earnings.

Related ETFs

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the “Risk Factors” section of the prospectus.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID (for UK, Channel Islands, Isle of Man investors) and to the KID (for European investors) before making any final investment decisions. The KIID and KID for this fund are available in local languages, alongside the prospectus via Vanguard’s website.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

For Swiss professional investors: Potential investors will not benefit from the protection of the FinSA on assessing appropriateness and suitability.

Vanguard Funds plc has been authorised by the Central Bank of Ireland as a UCITS and has been registered for public distribution in certain EEA countries and the UK. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisers on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited is a distributor for Vanguard Funds plc.

For Swiss professional investors: The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Investments Switzerland GmbH is a financial services provider, providing services in the form of purchase and sales according to Art. 3 (c)(1) FinSA . Vanguard Investments Switzerland GmbH will not perform any appropriateness or suitability assessment. Furthermore, Vanguard Investments Switzerland GmbH does not provide any services in the form of advice. Vanguard Funds Series plc has been authorised by the Central Bank of Ireland as a UCITS. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisors on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

For Swiss professional investors: Vanguard Funds plc has been approved for offer in Switzerland by the Swiss Financial Market Supervisory Authority. The information provided herein does not constitute an offer of Vanguard Funds plc in Switzerland pursuant to FinSA and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for Vanguard Funds plc. The Representative and the Paying Agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Copies of the Articles of Incorporation, KID, Prospectus, Declaration of Trust, By-Laws, Annual Report and Semiannual Report for these funds can be obtained free of charge from the Swiss Representative or from Vanguard Investments Switzerland GmbH via our website.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

The Indicative Net Asset Value (“iNAV”) for Vanguard’s ETFs is published on Bloomberg or Reuters. Refer to the Portfolio Holdings Policy.

For investors in Ireland domiciled funds, view out summary of investor rights and is available in English, German, French, Spanish, Dutch and Italian.

For Dutch investors only: The fund(s) referred to herein are listed in the AFM register as defined in section 1:107 Dutch Financial Supervision Act (Wet op het financieel toezicht).For details of the Risk indicator for each fund listed, please see the fact sheet(s) which are available from Vanguard via our website.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited ("BISL") (collectively, "Bloomberg"), or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices.

The products are not sponsored, endorsed, issued, sold or promoted by “Bloomberg.” Bloomberg makes no representation or warranty, express or implied, to the owners or purchasers of the products or any member of the public regarding the advisability of investing in securities generally or in the products particularly or the ability of the Bloomberg Indices to track general bond market performance. Bloomberg shall not pass on the legality or suitability of the products with respect to any person or entity. Bloomberg’s only relationship to Vanguard and the products are the licensing of the Bloomberg Indices which are determined, composed and calculated by BISL without regard to Vanguard or the products or any owners or purchasers of the products. Bloomberg has no obligation to take the needs of the products or the owners of the products into consideration in determining, composing or calculating the Bloomberg Indices. Bloomberg shall not be responsible for and has not participated in the determination of the timing of, prices at, or quantities of the products to be issued. Bloomberg shall not have any obligation or liability in connection with the administration, marketing or trading of the products.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.