Four charts to coach your clients through market turbulence

When markets are selling off, these volatility-related charts can help provide perspective to reassure clients to remain calm and stay the course.

When markets are selling off, these volatility-related charts can help provide perspective to reassure clients to remain calm and stay the course.

Equity market volatility fuelled by concerns around the impact of trade tariffs and geopolitical uncertainty may be unnerving for some investors – and there could be further turbulence in the weeks and months ahead.

For advisers, large market swings can prompt challenging conversations with clients, particularly when markets are falling and their portfolios are losing value.

Here, we share four key charts to help advisers encourage their clients to maintain a long-term focus and stick with their investment strategies when markets turn turbulent.

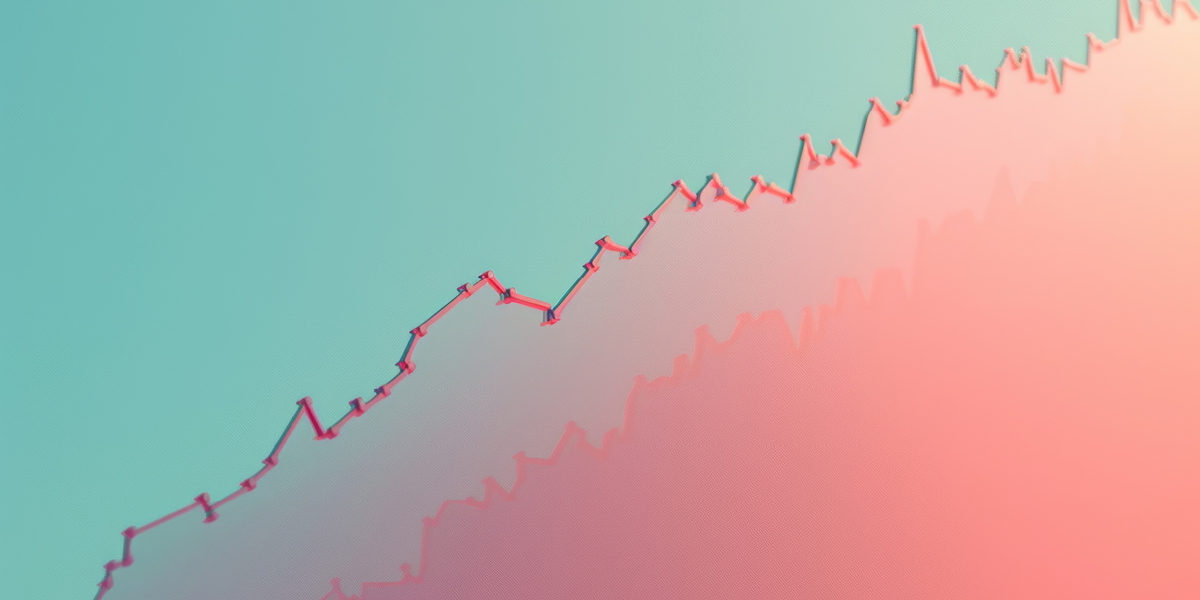

Short-term volatility is a normal part of investing. This chart shows that, despite periods of high volatility that have often coincided with market pullbacks, equity markets have climbed over the long term

Past performance is not a reliable indicator of future results.

Notes: The chart shows the trailing 30 business day volatility of daily index returns (LHS) and the price index (RHS) of the MSCI World Price Index from 1 January 1982 to 31 December 1987 and the MSCI AC World Price Index thereafter.

Source: Vanguard calculations in CHF, based on data from Refinitiv, as at 3 July 2024.

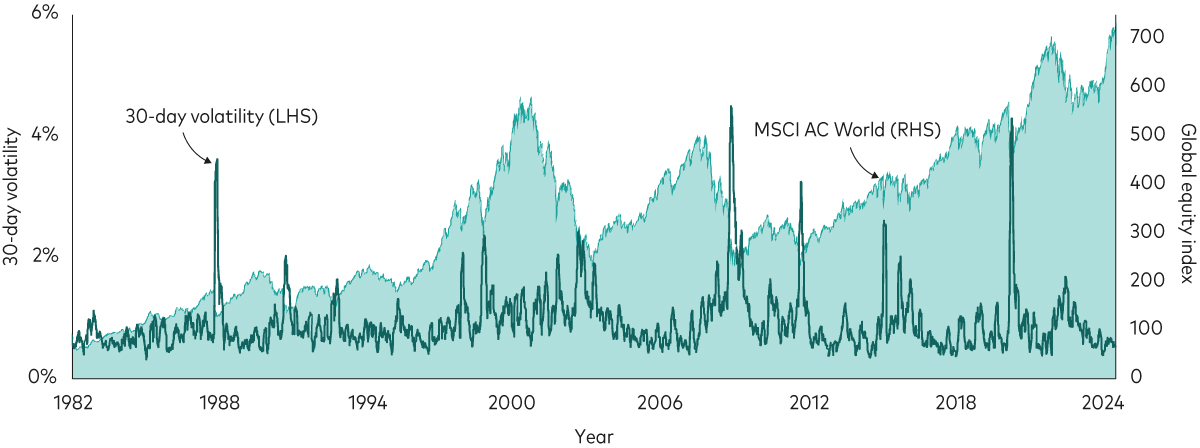

Bear markets and corrections are a part of life for investors, who are best served by maintaining a long-term focus.

Since 1972, there have been 13 bear markets in global equities, from a Swiss franc investor’s perspective. History shows that equities typically recover and go on to post strong results over the long term.

Past performance is not a reliable indicator of future results.

Notes: The chart shows the MSCI World Price Index from 1 January 1972 to 31 December 1987 and the MSCI AC World Price Index thereafter. The shaded areas represent bear markets, defined as price decreases of more than 20% from the previous peak to the trough.

Source: Vanguard calculations in CHF, based on data from Refinitiv, as at 3 July 2024.

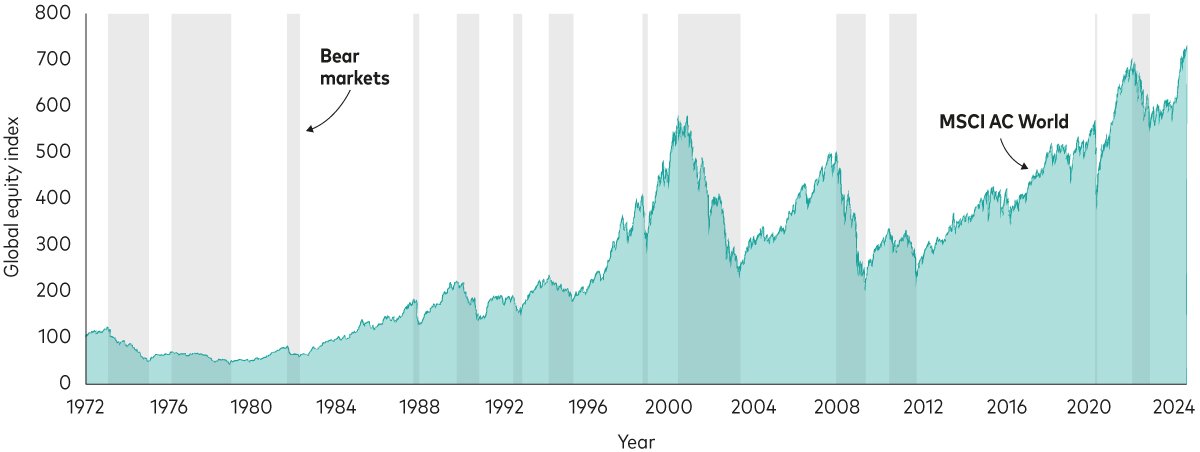

One reason investors shouldn’t try to time the market is they run the risk of missing out on strong performance, which can seriously hamper long-term investment success.

Historically, the best and worst trading days have tended to cluster in brief time periods, often during periods of heightened market uncertainty and distress, making the prospect of successfully timing the market improbable.

Past performance is not a reliable indicator of future results.

Notes: The chart shows daily returns of the MSCI World Price Index from 1 January 1980 to 31 December 1987 and the MSCI AC World Price Index thereafter. The green bars highlight the 20 best trading days since 1 January 1980 and the gold bars highlight the 20 worst trading days since 1 January 1980.

Source: Vanguard calculations in CHF, based on data from Refinitiv, as at 3 July 2024.

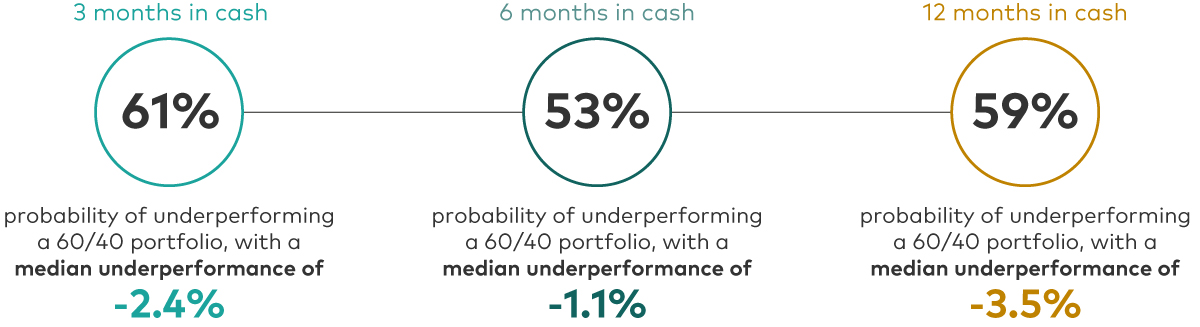

Fast and significant market downturns are infrequent. When they do occur, investors can feel frightened and move their portfolios into cash - an action made doubly challenging by then having to pick the right time to move back into the market. Long periods out of the market can end up making matters worse.

Past performance is not a reliable indicator of future results.

Notes: The chart shows the distribution of excess returns of cash over a global 60% equity / 40% fixed income portfolio over the 3-, 6- and 12-month periods after 3-month total returns of global equities were below 5%. Equity comprises global equities (MSCI AC World Total Return Index). Fixed income comprises global bonds (hedged) (Bloomberg Global Aggregate Bond Index Swiss Franc Hedged). Cash is represented by CHF 3-month deposits, which mirrors what an individual could get in a 3-month fixed-rate savings account. Data based on the period between 28 February 1999 and 30 June 2024.

Source: Vanguard calculations in CHF, based on data from Refinitiv, as at 3 July 2024.

Use Vanguard’s five simple investing tips with your clients to help them avoid overreacting to short-term downturns and stay on course for long-term investment success.

There's an old adage that you should never check your account when stocks are tanking. It's smart advice. As the charts above show, making a hasty decision usually results in a mistake.

If market corrections are making you lose sleep, it may be time to reevaluate your risk tolerance

Expenses erode your returns. This is particularly painful when stock markets are correcting.

Historical return averages are simply that–averages–and returns could be lower in any given year.

A great way to insulate your portfolio is to have exposures to stocks, bonds and international markets in an asset allocation plan that makes sense for your risk tolerance and goals. Bonds can act as a ballast during downturns. International exposure can give you access to markets that may generate positive performance when others are falling.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.