- We see a positive outlook for fixed income investors this year and beyond, with global bonds offering an effective way to gain broad exposure to the asset class.

- A float-adjusted and scaled index approach to accessing diversified global bond exposure can provide a better total return opportunity compared with a traditional, market-capitalisation-weighted index.

- Float-adjusted indices offer a more accurate reflection of the investible market and can help to mitigate risk for investors in countries where central banks have large bond holdings.

Prospects for bonds are stronger than they have been in years. As laid out in our outlook for 2024, we believe the return to sound money—or the persistence of positive real interest rates—marks the single best development for bond investors in 20 years. For the fixed income allocation in portfolios, hedged global bonds represent a compelling way to gain efficient and cost-effective exposure. At Vanguard, our global bond ETFs and index funds track indices based on a float-adjusted and scaled methodology, which we believe offers a compelling total return opportunity.

Tilting towards fundamental strengths – and away from weaknesses

Since the Bloomberg Global Aggregate Float Adjusted and Scaled Index went live in March 2019, it has harnessed higher income and lower valuations relative to a traditional, market-capitalisation-weighted approach, indicating a total-return proposition led foremost by better fundamentals (as the chart below shows), in this case yield. In simple terms, a buy-and-hold strategy in the float-adjusted and scaled approach since 2019 would have reinvested a 4 basis points (bps) higher average coupon rate back into an 8 bps higher average yielding bond, relative to a traditional index.

Float-adjusted indices are yield-led because they underweight bond markets experiencing exceptional monetary support, such as what we have seen from the Bank of Japan (BoJ) and its yield curve control (YCC) programme. The monetary support provides an artificial boost in price, and thus the bonds held by the BoJ would be low yielding; consequently, by underweighting this segment of the Japanese bond market, the float-adjusted index has a higher yield. While the BoJ has announced an end to YCC, Japan still faces a variety of structural challenges—such as high government debt and tepid economic growth—and thus we do not expect the BoJ to dramatically curtail its bond purchases for the foreseeable future.

In terms of methodology, float-adjusted indices aim to provide a more accurate representation of the investible market by adjusting the weights of individual securities based on their available float, or the portion of issues that are available for trading in the open market. This approach recognises that not all bonds are readily accessible to investors, as some may be held by central banks, governments or other entities, providing a more realistic representation of the bond market's composition and size.

Harnessing income with float-adjustment

Relative coupon rates and yield to worst

Source: Bloomberg. Data as of 30 November 2023. Float-adjusted and scaled = Bloomberg Global Aggregate Float Adjusted and Scaled Index. Non-float-adjusted/scaled = Bloomberg Global Aggregate Index. Bloomberg Global Aggregate and Bloomberg Global Aggregate Float Adjusted and Scaled indices float adjust US Treasuries, Agencies and MBS. Yield to worst (YTW) is a financial metric used to estimate the lowest potential yield an investor could receive from a bond or other fixed-income security over its remaining term to maturity. It represents the yield an investor would earn if the bond were to be called, redeemed, or matured at the earliest possible date that would result in the lowest yield. YTW takes into account various scenarios that could impact the yield of a bond, including early redemption, call provisions and other factors that may affect the cash flows received by the investor. It provides a conservative estimate of the potential return on investment, as it assumes the least favourable outcome for the investor.

Factoring in the effect of interest compounded over multiple years would translate into higher accrued income yield for the float-adjusted and scaled exposure by 4 bps after year 1, 13 bps after year 3 and 23 bps (per annum) after year 5. These small basis-point differences in coupon and yield can, over time, grow large enough to start making a meaningful impact by helping to offset costs associated with implementation (for example, index currency hedging and optimised sampling costs) or the OCF (ongoing charges figure).

And thanks to compound interest, the income accrued becomes the more durable and dominant performance contributor over longer investment holding periods. Multi-decade cumulative total returns for global bonds, regardless of the index methodology, have come predominantly from compound interest – little, if anything, has come from price.

Shorter holding periods wouldn’t change the argument in favour of compound interest. For instance, holding global bonds for five years in any period since 1998 would see accrued interest, on average, contributing around five times the contribution of price – that is, we observed this outcome whenever the price return contributed positively, because for about half the time it was negative and acted as a drag on total returns.

The case for float-adjusting going forward

Unlike accrued interest, price is not a durable performance driver for bonds. Its impact on total return is subject to the direction of interest rates, which, when not driven by sentiment, are cyclical. And against a “higher-for-longer” bond market narrative fading into the distance, repositioning fixed income index investing as a total return opportunity in 2024 sets up float-adjusted exposures to capture potential total returns in bond markets particularly well.

The timing is convenient. The float-adjusted and scaled global bond index has a bias towards the US and Europe, whereas the alternative, traditional approach has biases toward China—where quantitative easing is already in full swing—and Japan, where the BoJ had until recently maintained its targeted intervention in Japanese government bonds (JGBs).

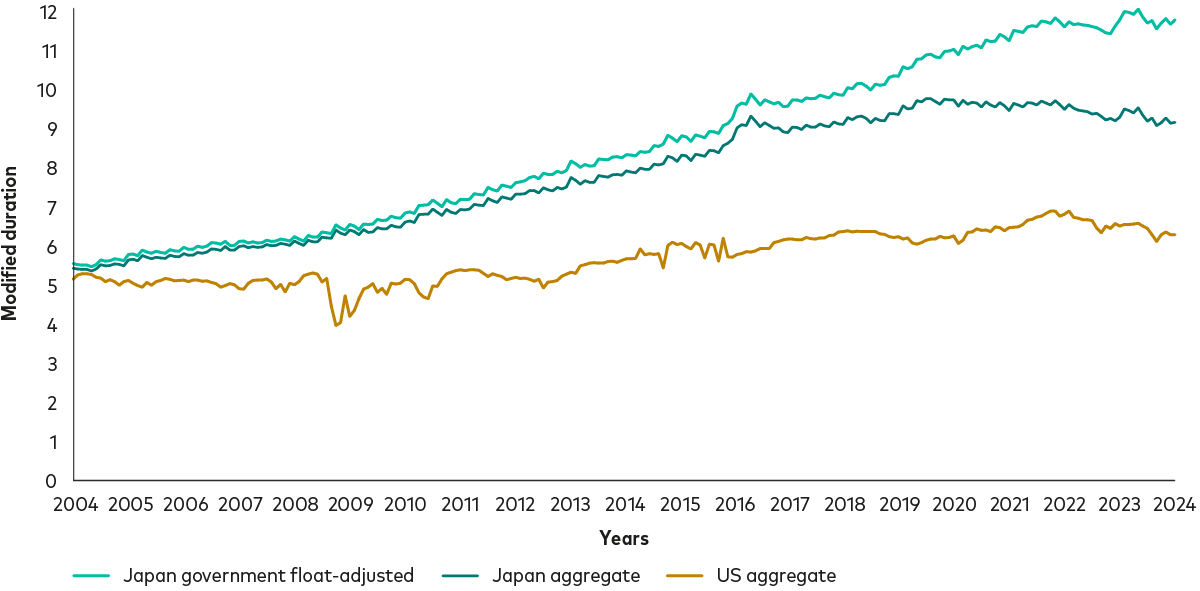

Notably, when factoring duration risk into price expectations for bond markets, JGBs stand out as both an immediate and longer-term challenge for global fixed income investors. A recent policy rate hike by the BoJ (from -0.1% to between zero and 0.1%) has set expectations that the BoJ will end its bond buying at some point, although for now the buying continues.

Magnifying the downside risk to the JGB market is its extended duration profile, a direct result of the BoJ’s targeted intervention in and around the 10-year tenor since the launch of YCC in 2016. This process has left the investible JGB universe skewed to maturities of 10 years and above–also known as long-term and ultra-long issues. An index approach to Japanese bonds mainly comprises JGBs1 and assumes high duration risk: 12 years of duration suggests the exposure is twice as sensitive to interest rates as US broad investment grade, as shown in the chart below.

Inherent risks in JGBs present replication challenges

Modified duration of exposures to Japan and US

Source: Bloomberg, Bank of International Settlements (BIS). Data as of 30 November 2023. Japan government float adjusted = Bloomberg Japan Government Float-Adjusted Index. Japan aggregrate = Bloomberg Asian-Pacific Japan government Index. US aggregrate = Bloomberg US Aggregate Index.

Mitigating Japan’s structural risk for investors through float-adjusted JGBs

As the chart above shows, not taking a float-adjusted approach to Japan means global bond ETFs and index funds tracking a traditional index strategy would need to rely heavily on optimised sampling to fully weight Japanese bonds – nearly 50% of which are inaccessible to investors.

Given the wide duration wedge between the float-adjusted and non-float-adjusted exposure—thanks to the BoJ’s YCC policy since 2016—traditional bond indices can, by design, pose significant challenges to fund managers who seek to track them. And investors may ultimately end up paying the price in terms of performance. We still see challenges for JGBs, and thus believe that JGBs bought and held to maturity by the BoJ should be excluded from the investible market cap for Japanese bonds.

An equally important consideration is the fundamental risk when index-weighting bond markets such as JGBs by market value. This risk is particularly acute when the size is artificially supported by a central bank’s considerable intervention powers, the absence of which would otherwise expose the bond market to market forces and reflect its true size.

The float-adjusted approach addresses these concerns and mitigates these risks for investors by reducing the allocation to Japanese bonds to around 6% (reducing by about half), versus 11% in the non-float-adjusted approach.

Core beta exposures should reflect a liquid, accessible market such that their implementation minimises the cost of ownership to investors. Similar to what is common practice in equity index management, securities that cannot be accessed by investors should not be part of core fixed income beta exposures. A float-adjusted and scaled index approach to accessing diversified global bond exposures can provide a better total return opportunity compared with a traditional, market-capitalisation-weighted index.

1 According to Bloomberg’s November rebalance, JGBs make up 96% of Japan’s total investment grade universe.

Related ETFs

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited ("BISL") (collectively, "Bloomberg"), or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices.

The products are not sponsored, endorsed, issued, sold or promoted by “Bloomberg.” Bloomberg makes no representation or warranty, express or implied, to the owners or purchasers of the products or any member of the public regarding the advisability of investing in securities generally or in the products particularly or the ability of the Bloomberg Indices to track general bond market performance. Bloomberg shall not pass on the legality or suitability of the products with respect to any person or entity. Bloomberg’s only relationship to Vanguard and the products are the licensing of the Bloomberg Indices which are determined, composed and calculated by BISL without regard to Vanguard or the products or any owners or purchasers of the products. Bloomberg has no obligation to take the needs of the products or the owners of the products into consideration in determining, composing or calculating the Bloomberg Indices. Bloomberg shall not be responsible for and has not participated in the determination of the timing of, prices at, or quantities of the products to be issued. Bloomberg shall not have any obligation or liability in connection with the administration, marketing or trading of the products.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2024 Vanguard Group (Ireland) Limited. All rights reserved.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2024 Vanguard Asset Management, Limited. All rights reserved.