Make use of our client-facing resources

Help your clients achieve peace of mind with Vanguard’s suite of ready-to-use explainers, from the latest economic and market outlook to making the best of the adviser-client journey.

By Shaan Raithatha, senior economist, Vanguard, Europe.

Despite collapsing natural gas prices, resilient industrial activity and a recovering euro, Europe’s energy crisis isn’t over. The region has adapted well to significantly lower Russian energy imports, and the energy shock appears milder than initially feared. As the nearly year-old war in Ukraine continues, however, Europe still faces three key threats.

How each of these play out could have a significant effect on the European economy, although the fallout elsewhere is likely to be more limited.

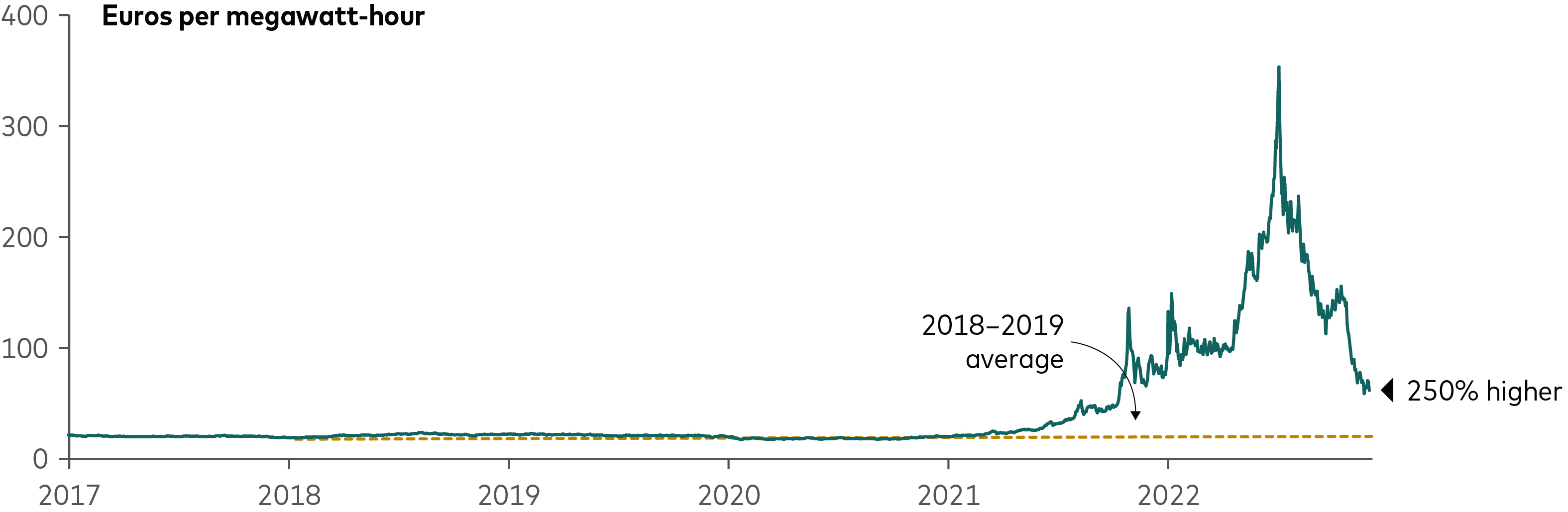

First, although European natural gas prices have fallen dramatically from their summer 2022 peak, they are still considerably higher than historical norms. The chart below shows that benchmark spot natural gas prices remain 250% above their pre-Covid-19 averages. The hit to household disposable incomes and industrial competitiveness remains substantial.

We are also unlikely to see energy prices return to pre-Covid levels anytime soon, given tighter environmental regulations and the higher marginal cost of energy imports outside of Russia.

Sources: Bloomberg, Vanguard, as of 25 January 2023.

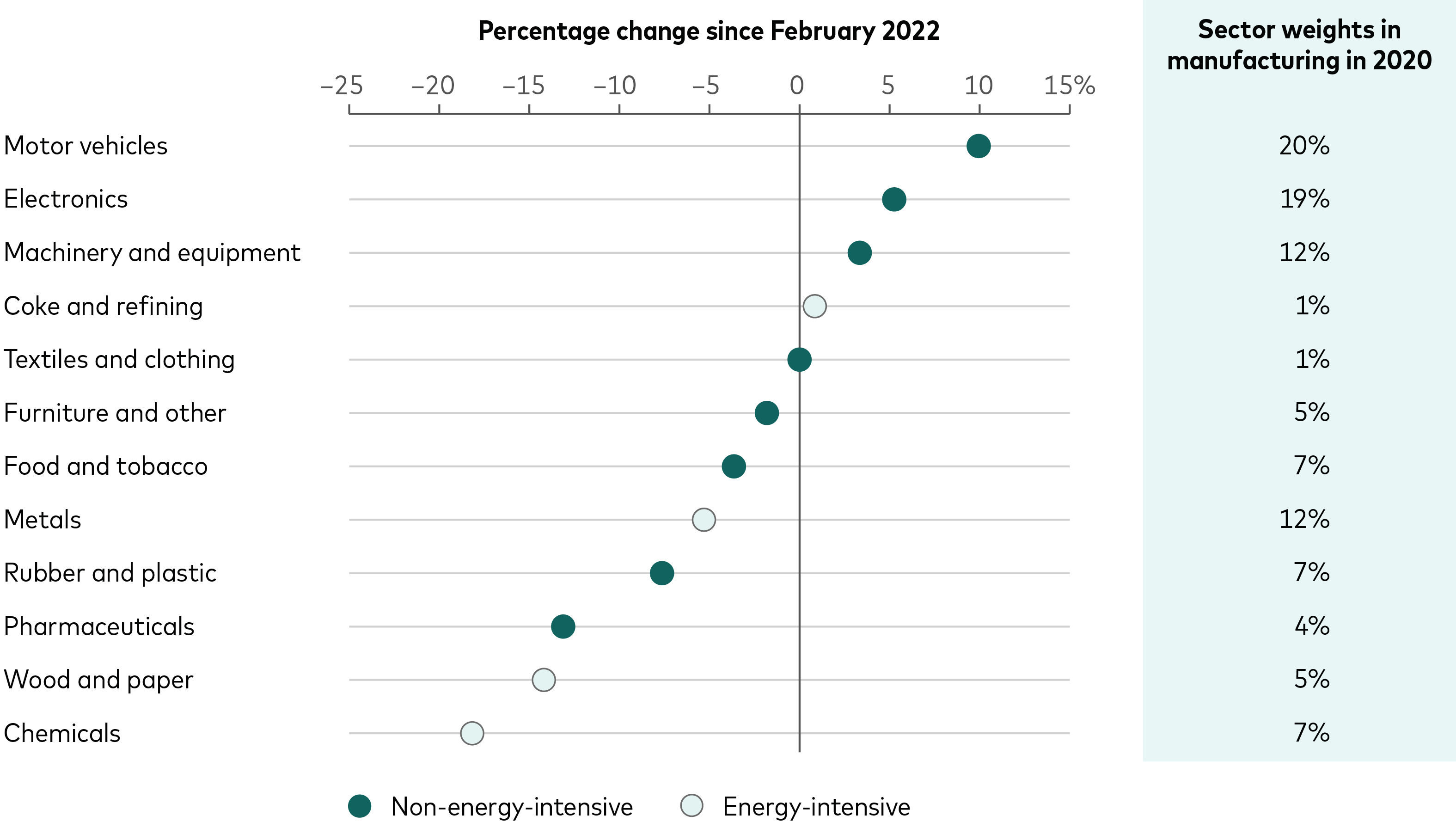

Second, despite recent data suggesting European industry is faring better than expected, a sectoral analysis reveals some underlying weaknesses.

The second chart below shows the percentage change in manufacturing production over the last year across different sectors in Germany, Europe’s biggest economy. It highlights the degree to which European industrial output has been dragged higher by a rebound in the production of cars, electronics (especially semiconductors), and machinery as the severe disruption to global supply chains caused by the Covid pandemic faded. Most energy-intensive sectors, though, including chemicals, metals, and wood and paper have suffered significant falls in production.

In our central scenario, we expect the boost to manufacturing from the normalisation of global supply chains to diminish by the second half of 2023. Therefore, if the weakness currently observed in energy-intensive sectors persists, there is a significant risk that the euro area will experience a contraction in industrial output. This could be the catalyst for a broader economic recession.

Change in German manufacturing production

Sources: Eurostat, Vanguard, Capital Economics, as of 25 January 2023.

Finally, another energy supply shock – perhaps caused by further escalation of tensions in Ukraine – cannot be ruled out. This is particularly pertinent, as Europe’s capacity to absorb another energy shock is limited.

A recent and highly regarded business survey1, for example, suggested more than half of German businesses might be forced to cut back or halt production to achieve additional natural gas savings, potentially weighing on jobs and economic growth.

In short, the energy crisis in Europe is far from over and the region’s economic prospects remain under a cloud.

We expect the euro area to be in recession in 2023 as the region’s economy contends with the lingering headwinds from the war and rising interest rates. That said, given the recent fall in natural gas prices, better-than-expected activity data, and China’s reopening, we now call for a milder contraction in output.

As we outlined in the Vanguard Economic and Market Outlook for 2023, we also expect inflation to remain above target and monetary policy rates in restrictive territory until 2024 at the earliest.

1 Source: IFO business survey, October 2022

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.