By Shaan Raithatha and Roxane Spitznagel, economists at Vanguard Europe

Headline inflation in the United States jumped by 5.0% year-on-year in May, the highest rate of price growth since 20081. This has revived concerns about whether the economy is running hot and whether the US Federal Reserve will bring forward when it will start ‘normalising’ monetary policy by raising interest rates and slowing its asset purchases.

Vanguard’s global chief economist, Joe Davis, recently explained what’s behind the rise in US inflation. What’s been given less media attention is that inflationary pressures are also mounting in Europe.

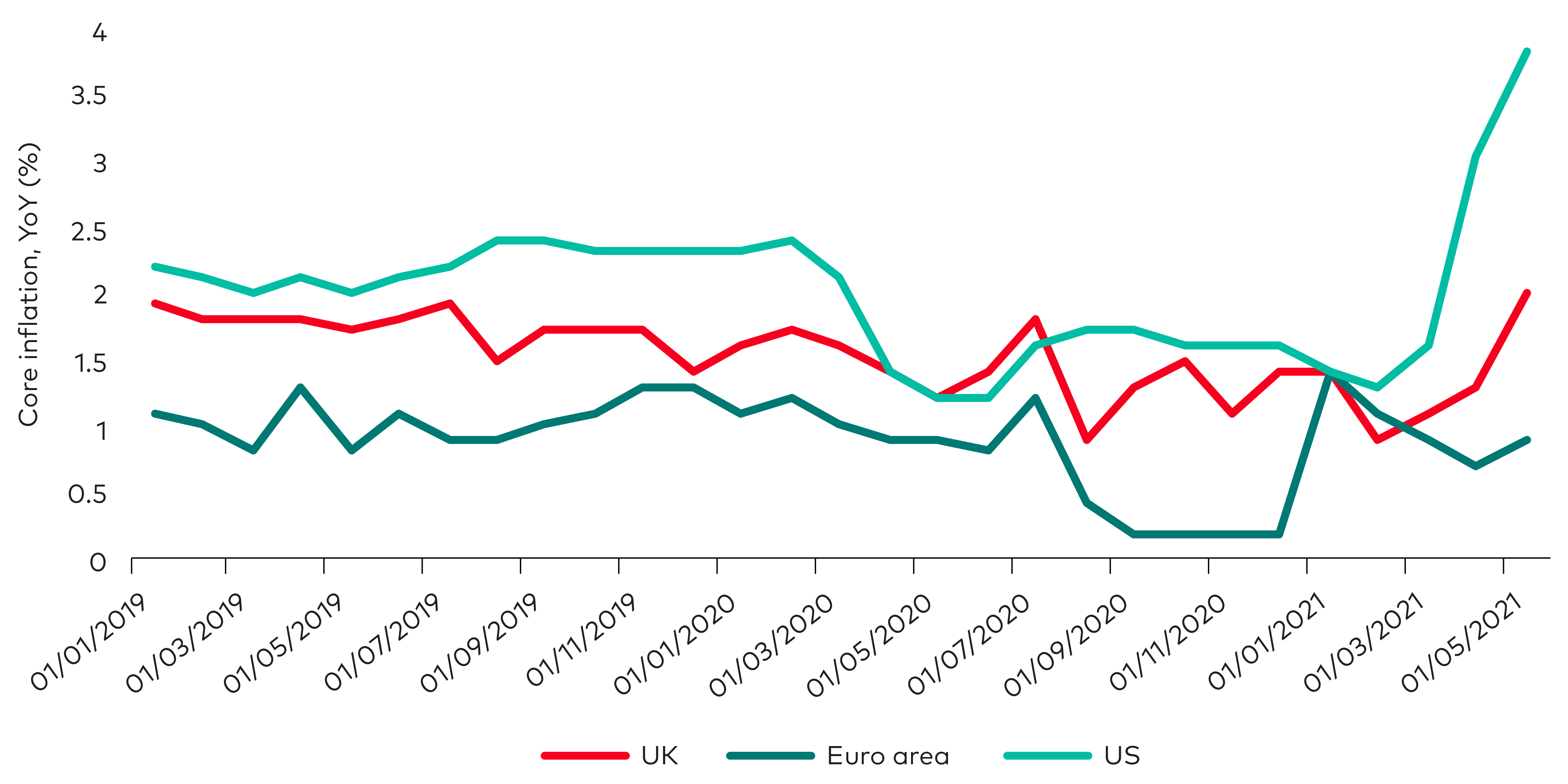

Headline inflation in May accelerated to 2.0% in the euro area and 2.1% in the UK, from 0.9% and 0.7% at the start of the year, respectively. Even though these rises were primarily driven by energy price inflation, core inflation (which excludes food and energy prices) is starting to rise as well, as the chart below shows.

Core inflation: Europe and US

Source: ONS, Eurostat, BEA, as at 31 May 2021

Given the US is further ahead in its recovery, is it a matter of time before we see similar inflationary pressures emerging in Europe as well?

European pressures less intense

We expect inflation in Europe to indeed rise further from here over the coming months. The forces underpinning this are similar to those in the US. These include higher energy prices, supply shortages in intermediate products such as semi-conductors and a rebound in demand as lockdown restrictions are eased.

The reversal of VAT tax cuts in Germany and the UK will also exert upward pressure on prices this year.

But we do not expect inflationary pressures to be as intense as in the US, partly because the demand impulse will not be as strong.

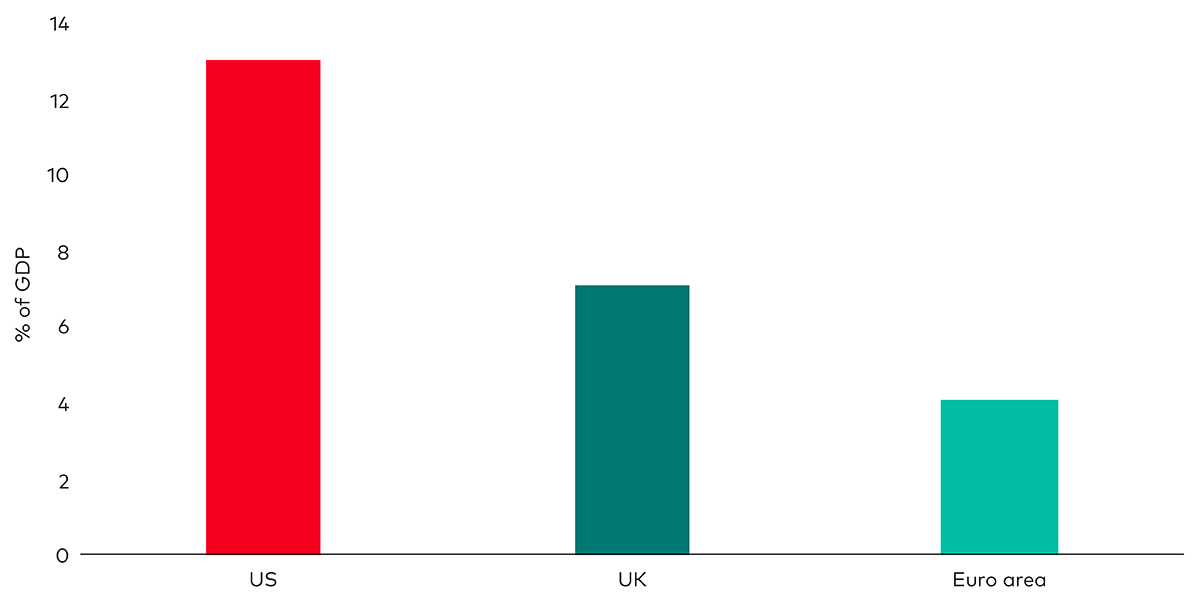

The chart below shows the total ‘excess savings’ accumulated by households as a direct result of the pandemic, in proportion to GDP. As is clear, the accumulated excess savings in the UK and euro area are less substantial, at only about a half and a third of the US, respectively.

That implies that there is more capacity for a substantial consumption boost in the US than in Europe once these savings are unwound.

Accumulated excess savings during the pandemic

Source: Vanguard, using underlying data from Bloomberg.

Another reason why we may expect greater inflationary pressure in the United States is related to the US Federal Reserve’s move a year ago to an average inflation targeting regime. This means the US central bank is more willing to tolerate inflation rising above 2% for periods of time than its counterparts in Europe. It also presents an increased risk that inflation expectations will move markedly higher.

The chart below shows our forecasts for inflation in the UK and euro area over the next 18 months. In both cases, we expect headline inflation to be above 2% in the second half of 2021.

But as we move into 2022, the unwinding of temporary factors such as higher energy prices and the reversal of tax cuts will fade. As a result, inflation is expected to fall back to around 1.5% and 1.9% in the euro area and UK, respectively.

Euro area and UK inflation outlook

Source: ONS, Eurostat and Vanguard calculations as at 31 May 2021

Bank of England more hawkish than ECB for now

We expect the European Central Bank (ECB) and Bank of England to ‘look through’ the inflation rises driven by transitory factors such as oil prices or global shortages.

Instead, we think the two central banks will focus on underlying inflationary pressures with the potential to be more persistent. This means focusing on both the demand-led recovery and what is happening to inflation expectations.

So, even if the increase in headline inflation is temporary, it could still matter if a surge in it causes inflation expectations to rise significantly, which could then lead to further price rises in the future.

It’s clear that a recovery is well under way in the United Kingdom. Hawkish tones by the Bank of England suggest they will stop emergency quantitative easing by the end of the year and will think about starting to lift interest rates soon after.

In the euro area, it’s a slightly weaker story. Here, policymakers will want to see further evidence of recovery coming through in the data, with the underlying inflationary pressures remaining weak, despite the recent relaxation of social restrictions.

The ECB forecasts euro area inflation at 1.4% in 2023 – still well below target. By contrast, the Bank of England expects UK inflation at target in 2023.

That implies loose monetary policy is set to remain in place for longer in Europe, especially in the euro area, despite currently higher inflation readings.

1 As measured by the US CPI index.

IMPORTANT INFORMATION

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland, this document is directed at professional investors and should not be distributed to, or relied upon by retail investors.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2021 Vanguard Group (Ireland) Limited. All rights reserved.

© 2021 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2021 Vanguard Asset Management, Limited. All rights reserved