- Spikes in market volatility are common and historically have given way to new peaks after a rebound.

- The best and worst trading days are often clustered together, making market timing very difficult to get right.

- A strategic allocation to global equities and bonds can offer some protection in a downturn and capture the gains from any subsequent market rebound.

Investors around the world are feeling the full force of market volatility as portfolio values decline, with both global equities and global bonds experiencing falls of around 20% since the beginning of the year1.

At the same time, real returns are being eroded as headline inflation continues to rise across most developed economies.

With markets falling and inflation ramping up, clients might feel they need to ‘do something’ to avoid further losses. This reaction is natural as research suggests taking action to address a perceived threat can boost confidence and may even reinstate feelings of control to regular levels2.

However, when it comes to investments, taking action in response to market turmoil may be detrimental to long-term objectives and derail a sound investment strategy. It is precisely at times like this that investors can benefit from the reassurance and guidance of a trusted adviser.

Lessons from the past

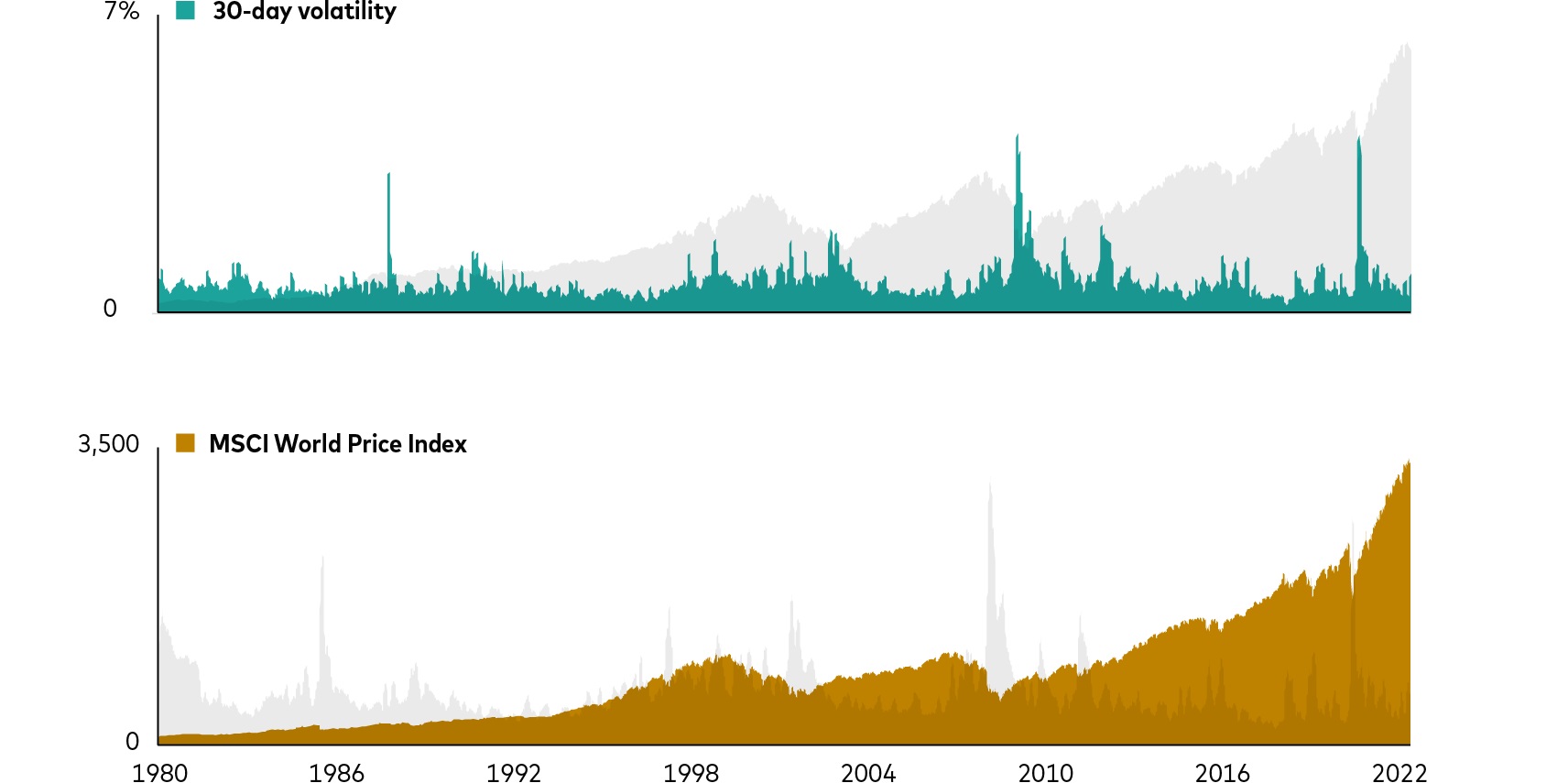

History can help put many of today’s challenges into perspective. For example, the heightened volatility we are experiencing currently is far from unusual. The chart below shows the volatility and price return of the MSCI World Index. We can see that volatility is a constant factor that tends to spike when stock markets endure a severe downturn. However, the inevitable troughs that investors will experience over time often give way to higher peaks.

History of volatility and long-term gains

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. Source: Vanguard calculations, using data from Refinitiv Datastream from 1 January 1980 to 21 January 2022. Data accessed on 24 January 2022. Notes: Volatility is calculated as the standard deviation of price returns from trailing 30 business days for the MSCI World Index. Returns calculated in USD without dividends reinvested.

For this very reason clients should continue to invest to finance long-term goals, such as retirement. Clients’ long-term goals, as per Vanguard’s four principles for investing success (goals, balance, discipline and cost), should always be forefront of mind when it comes to portfolio activity.

Some investors might interpret the previous chart as an opportunity to time markets, i.e., selling assets when markets are falling and reinvesting when sentiment picks up as prices begin to rise. Timing markets is notoriously difficult to do – even for professional fund managers3 – and could easily result in missed gains.

Our research has also found that the best and worst trading days often occur close together and irrespective of the overall market performance for that year, as the next chart demonstrates.

Timing the market is futile

Source: Vanguard calculations, based on data from Refinitiv using the Standard & Poor’s 500 Price Index. Data between 1 January 1980 and 31 January 2022. Returns calculated in USD without dividends reinvested.

The analysis found that the best- and worst-performing days are often clustered and an investor who sells after a big down day may miss a subsequent recovery. Further, 11 of the 20 worst trading days occurred in years of a positive total market return. We think there is a clear message for clients here – that even a bad year for markets can deliver some of the best single-day returns an investor will experience in their lifetime.

Maintain a long-term perspective

History has shown that often the best response to a market downturn is to maintain discipline with a strategic allocation to global equities and global bonds commensurate with the investor’s tolerance for risk and their investment goals. Unless those goals change, investors must resist the urge to change tactics in response to current market turmoil and maintain a long-term perspective.

1 Source: Vanguard calculations, based on data from MSCI and Bloomberg. Global equities represented by the MSCI All Country World Index (in USD). Global bonds represented by the Bloomberg Global Aggregate Index (in USD). Data from 3 January 2022 to 22 June 2022.

2 Landau et al., 2015. ‘Compensatory control and the appeal of a structured world’.

3 Vanguard calculations, using data from Morningstar. Data between 3 January 2011 and 31 December 2021. Notes: Analysis found strategic allocation funds generated higher median returns with less dispersion than funds with tactical allocations over one-, three-, five- and 10-year horizons.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Important information

This is an advertising document.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities. The prospectus or the Statement of Additional Information contains a more detailed description of the limited relationship MSCI has with Vanguard and any related funds.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2022 Vanguard Group (Ireland) Limited. All rights reserved.

© 2022 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2022 Vanguard Asset Management, Limited. All rights reserved.