- Looking at the job-loss rate, which can be more instructive than other labour-market measures, the US appears to be on a firm footing heading into 2025.

- Ongoing investment in technology and R&D could help to drive economic growth in the US, providing tailwinds to productivity.

- Given our expectations around shelter price inflation, we don’t see US core inflation falling to the Fed’s 2% target in the coming year.

Continued US robustness may owe more to fortuitous supply-side factors such as productivity growth and a surge in available labour than it does to traditional definitions of a “soft landing.” As we consider the path forward in 2025, what are some of the key areas that could affect the trajectory of the US economy? Our economists share their views.

1. Employment: In a consumer-driven economy, mind the labour market

Adam Schickling, Vanguard Senior Economist

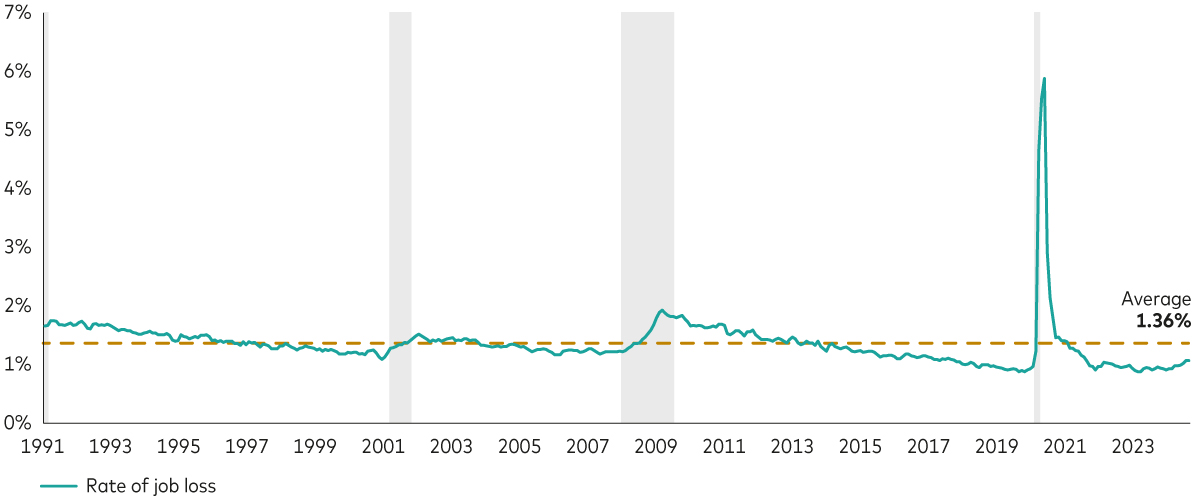

Heavily followed labour-market measures, such as the unemployment rate, can obscure the sources of increases in unemployment. Because the job-loss rate focuses on demand, and reduced demand is a more worrisome economic signal than increased supply, the job-loss rate is a good barometer. It measures the probability of a worker becoming unemployed in any given month.

With nearly 162 million workers on US payrolls, even a 0.1 percentage point rise in the job-loss rate would translate to nearly 162,000 additional workers becoming unemployed, which can have knock-on effects for consumer activity. The job-loss rate stood at 1.07% in September 2024, up from 0.91% eight months earlier but still well below its historical average of 1.36%, suggesting the US economy remains well-positioned entering 2025.

Monthly probability of a US worker becoming unemployed

Notes: For any given month, the job-loss rate reflects the number of workers who moved from employed to unemployed divided by the employment level in the prior month. Data reflect the period from January 1991 through September 2024. Shaded areas represent US recessions, as determined by the National Bureau of Economic Research.

Sources: Vanguard calculations, based on U.S. Bureau of Labor Statistics data from the Federal Reserve Bank of St. Louis (FRED).

2. Investment: Above-trend business investment in technology and R&D

Rhea Thomas, Vanguard Economist

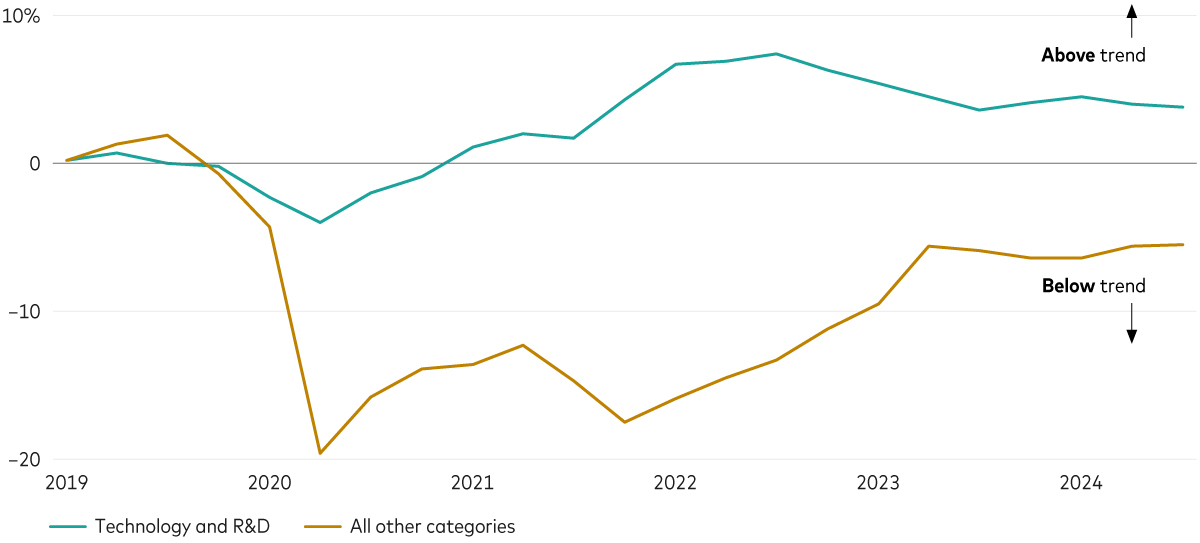

Business investment—spending that accounts for nearly 14% of US economic output on long-lasting assets used to produce other goods or services—has almost fully recovered to its pre-pandemic trend, according to recently revised government tallies of gross domestic product and its components over the last five-plus years.

What stands out is that this improvement has largely been concentrated in a few categories—software, information processing equipment and research and development (R&D)—that tend to be productivity-enhancing in the long run. Such spending now accounts for roughly 50% of business investment and has been above trend since 2021. Other categories of business investment remain below trend.

We expect ongoing technology and R&D investments to contribute to US economic growth in 2025 and to support the productivity tailwinds that have pushed up our estimate of potential growth.

US business investment in technology and R&D versus all other categories: Changes from pre-pandemic trends

Notes: Business investment reflects inflation-adjusted spending by US businesses and nonprofits on fixed, domestic, nonresidential structures, equipment and intellectual property products. Technology investment reflects spending on software and information processing equipment. The data in the chart reflect quarterly changes in the two broad categories compared with their pre-pandemic (2015-2019) trends, from the first quarter of 2019 through to the third quarter of 2024, as measured by the US Bureau of Economic Analysis as part of annual revisions issued on 26 September 2024.

Sources: Vanguard calculations, using U.S. Bureau of Economic Analysis (BEA) data from Macrobond.

3. Inflation: Falling US shelter inflation must recede further

Ryan Zalla, Vanguard Economist

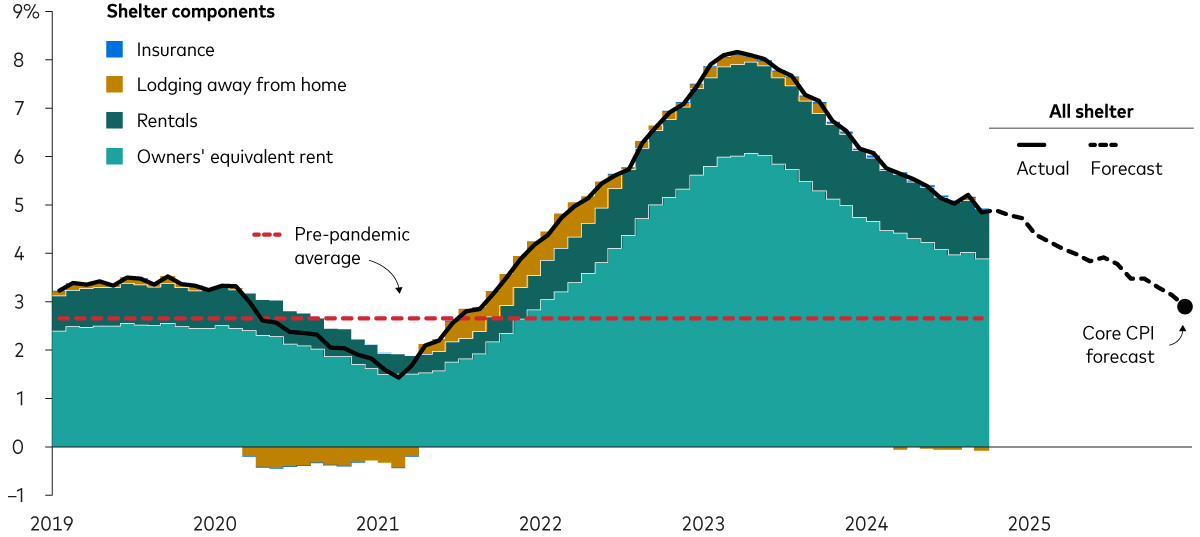

Shelter accounts for 45% of the US core Consumer Price Index (CPI) and 17% of the core Personal Consumption Expenditures Price Index. That’s why further reductions in shelter inflation—recently still climbing at a 4.9% year-over-year rate—will be necessary in order for core inflation, which excludes food and energy, to return to the US Federal Reserve’s (Fed's) 2% target. We don’t think its goal will be met anytime soon.

We expect shelter inflation to remain above 3% throughout 2025, consistent with our 2.9% forecast for the core CPI at year-end 2025. Although leading indicators suggest that rents will fall and the Fed has indicated it will look through shelter inflation, upside risks may emerge. We’re watching the potential for tighter trade and labour availability that could limit new housing supply, as well as interest rates that could remain high enough to discourage existing homeowners from selling. All three factors could delay the shelter recovery and keep prices elevated throughout the upcoming year.

Contributions to year-over-year US shelter price changes

Notes: Shelter components reflect monthly Consumer Price Index (CPI) data. Owners’ equivalent rent measures the inflation in single-family homes by estimating how much they would cost to rent. The pre-pandemic average (2.7%) reflects year-over-year changes in the CPI’s all-shelter component from January 2001 through to December 2019.

Sources: Vanguard (for the all-shelter and core CPI forecasts) and Refinitiv Eikon Datastream (for historical U.S. Bureau of Labor Statistics data through to September 2024).

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information does not constitute legal, tax, or investment advice. You must not, therefore, rely on it when making any investment decisions.

The information contained herein is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2025 Vanguard Group (Ireland) Limited. All rights reserved.

© 2025 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2025 Vanguard Asset Management, Limited. All rights reserved.