- For investors considering an allocation to ESG USD corporate bond index strategies, it’s important to understand the screening process and resulting exposure.

- The index methodology behind the Vanguard ESG USD Corporate Bond UCITS ETF tilts towards new-economy industries (i.e., communications and technology) and raises credit quality, compared with the parent benchmark.

- The screening process has minimal impact on the yield and duration profile, meaning the income proposition of the ESG exposure is nearly identical to the parent index on both an absolute and risk-adjusted basis.

Fixed income investors are likely familiar with the rationale for investing in USD corporate bonds. Investment-grade corporate bonds can offer a reliable source of income and diversification for an investment portfolio, helping to reduce overall volatility given the stability of the issuers. But can investors find an exposure that meets these goals while also aligning with ESG considerations? We believe the answer is yes and, as we explain below, the profile of an ESG-screened index can even have compelling attributes beyond what we find in the parent index.

Screening and selection for ESG in USD corporates

The Vanguard ESG USD Corporate Bond UCITS ETF, which conforms with Article 81, offers investors a USD corporate bond exposure with an ESG overlay.

The ETF tracks the Bloomberg MSCI USD Corporate Float-Adjusted Liquid Bond Screened Index. This index exposure consists of global corporate bonds denominated in US dollars, and the methodology screens out companies involved in certain business activities, such as the production and sale of alcohol, weapons and fossil fuels (see table below for full list of exclusion categories). This process is known as “exclusionary screening”.

Private placements that are exempt from Securities and Exchange Commission (SEC) registration2 are also not eligible for inclusion in the index, given they lack the transparency of both issuer and owner – unlike publicly traded debt.

The index has a relatively large minimum issue size requirement of $750 million compared with the parent index ($500 million) or comparable strategies, which tend to have minimum requirements of $500 million or less. In addition, the index excludes eurodollar bonds, which are USD-denominated bonds sold outside the US and which tend to have relatively shallow underlying markets and limited trading. Together, these two criteria bolster the liquidity profile of the underlying USD corporate bonds in the exposure.

Finally, the index is float-adjusted, so it excludes USD-denominated investment-grade corporate debt held by the US Federal Reserve. Until resale in public markets, these securities remain inaccessible to investors and thus are excluded.

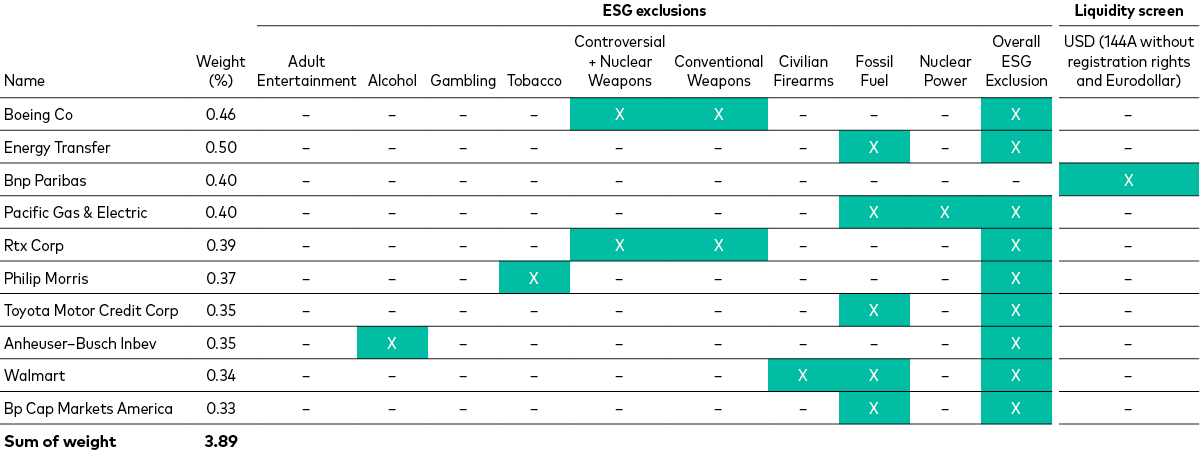

The table below shows the top 10 exclusions from the screened benchmark relative to the parent index. These exclusions comprise around 4% of the weight of the global USD corporate bond universe, as of end-August 2024.

Top 10 largest ESG and liquidity exclusions of USD corporate bond issuers

Source: Bloomberg, MSCI screening files. Data as of 30 August 2024. X refers to the criteria where the issuer failed in the ESG screening methodology. Top 10 exclusions screened from the Bloomberg Global Aggregate USD Corporate Index, which is the parent index of Bloomberg MSCI USD Corporate Float-Adjusted Liquid Screened Bond Index.

Fundamentals: New-economy tilt raises credit quality, improves tracking

When we screen out such a diverse set of bellwether companies, how does it affect the fundamentals and performance profile of the parent USD corporate bond exposure?

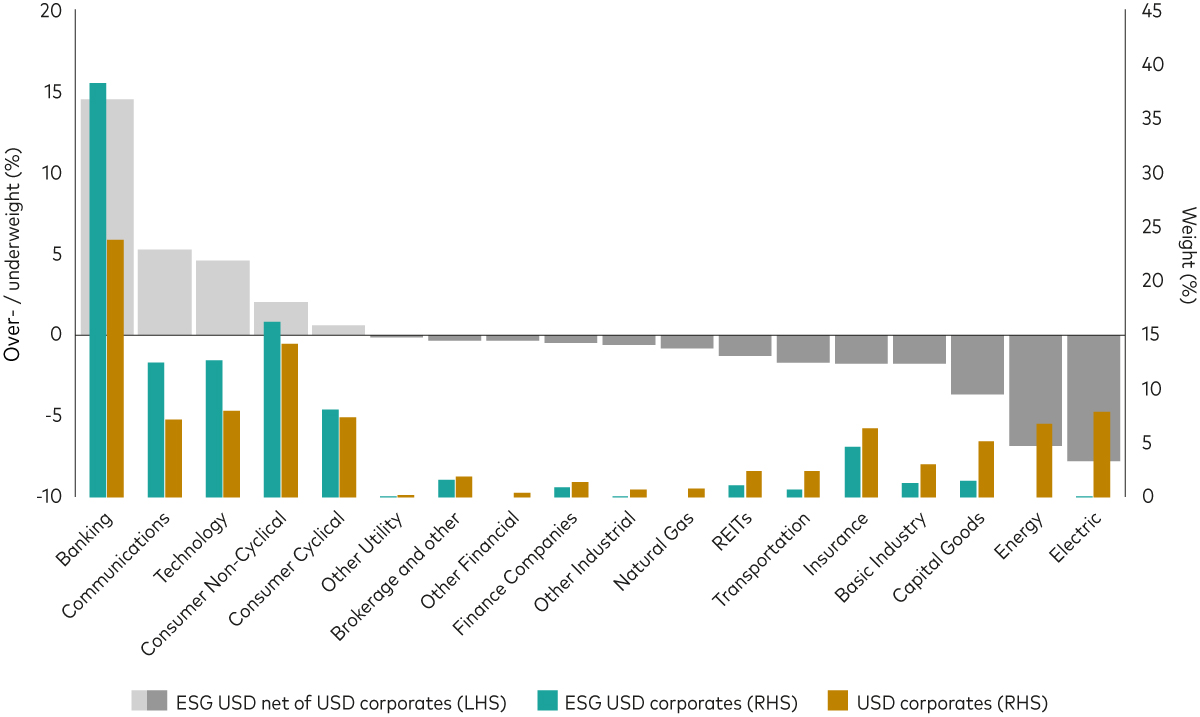

Fossil fuel involvement is the dominant exclusion criteria. Issuers across utilities (natural gas, electric), energy and capital goods feature as the largest industry underweights, with little to no allocation in the ESG exposure (see chart below). Reweighting on a pro rata basis, after the additional screens, means the fossil fuel exclusions tilt the ESG exposure further towards the financials sector, with banks seeing the largest net increase of 14 percentage points (to 38%), more than offsetting any impact the liquidity screen has on private placements and eurodollar bond issues.

We also see a tilt towards communications and technology, two so-called “new-economy” industries which have low indebtedness with capacity to lever up. Of note, US mega tech companies—including members of the “Magnificent 7”3—issue bonds to fund share buybacks, in sharp contrast to funding the heavy capital expenditure needs of large firms from the capital goods, energy and utilities industries. As a result, the ESG screen will reweight Apple, Amazon and Microsoft higher, doubling their combined weight to 4%. The different corporate funding needs illustrate the diversification benefits of the ESG-screened exposure (otherwise dominated by financials).

Banks and new-economy industries as main overweights

Source: Bloomberg. Data as of 31 August 2024. ESG USD Corporates = Bloomberg MSCI USD Corporate Float-Adjusted Liquid Screened Bond Index; USD corporates = Bloomberg Global Aggregate USD Corporate Index. Industries shown are Bloomberg’s BCLASS 3 classifications.

A natural consequence of the overall higher investment-grade credit quality profile is the slightly higher premium at which the ESG exposure’s underlying bonds trade. Given the immaterial impact to the yield (discounted by a few basis points) and to the duration profile, the income proposition is nearly identical to the parent index on both an absolute and risk-adjusted basis.

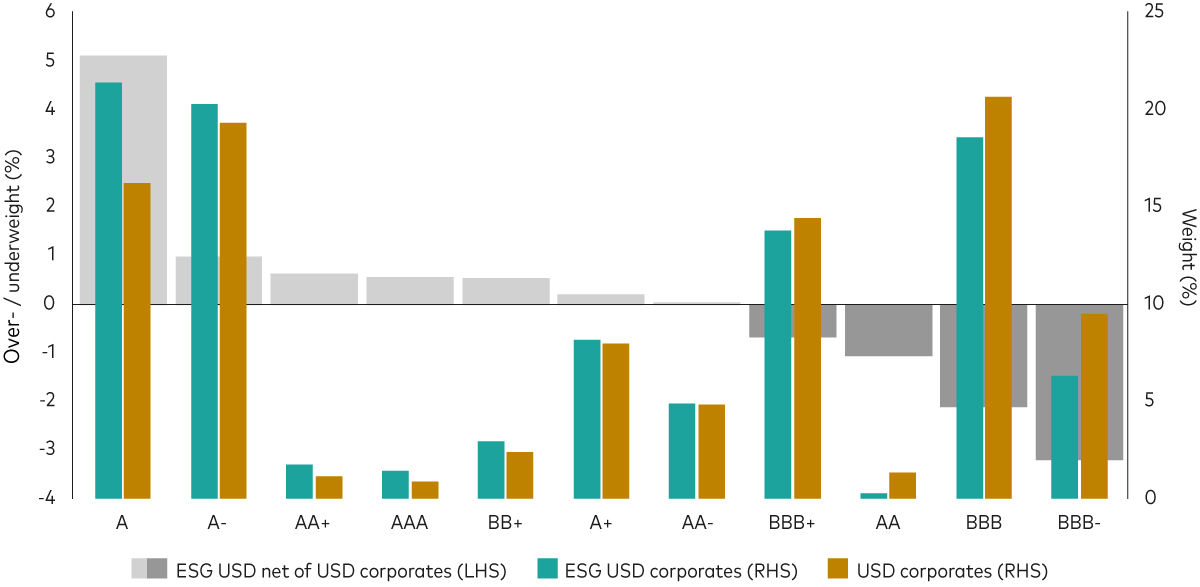

The implications for investors are that ESG-screened USD corporate bonds have, overall, an improved quality of issuers in the exposure versus the parent (see chart below). For example, the 5% overweight in single A-rated debt underweights borderline investment grade (BBB-rated) debt by the same magnitude, thus mitigating the risk of holding “fallen angels” in a portfolio. Fallen angels, or bonds that lose their investment-grade rating and slip to junk-bond status, increase turnover in the portfolio and create replication challenges for fund managers looking to preserve the ETF’s tight tracking to the benchmark.

High-grade bias after cuts to borderline investment-grade

Source: Bloomberg. Data as of 31 August 2024. ESG USD Corporates = Bloomberg MSCI USD Corporate Float-Adjusted Liquid Screened Bond Index; USD corporates = Bloomberg Global Aggregate USD Corporate Index. Credit ratings shown on are Bloomberg’s Composite Ratings.

For investors seeking ESG-screened corporate bond exposure for their fixed income portfolios, the Vanguard ESG USD Corporate Bond UCITS ETF is a compelling investment solution. The ESG approach of this ETF exposure goes beyond screening out “bad actors”. By embedding liquidity screens, it harnesses higher quality in investment-grade bonds and offers enhanced diversification potential for fixed income portfolios, especially during periods of lingering high inflation and interest rates.

1 Article 8 funds are defined by the Sustainable Finance Disclosure Regulation (SFDR) as those that promote environmental or social characteristics, provided the companies in which the investments are made follow good governance practices.

2 Issued under rule SEC 144A without registration rights.

3 In our context, Magnificent 7 refers to the companies Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla.

Related funds

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

For further information on risks please see the “Risk Factors” section of the prospectus.

Important information

This is directed at professional investors and should not be distributed to, or relied upon by retail investors.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KID before making any final investment decisions. The KID for this fund is available in local languages, alongside the prospectus via Vanguard’s website.

The information contained herein is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Potential investors will not benefit from the protection of the FinSA on assessing appropriateness and suitability.

The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Investments Switzerland GmbH is a financial services provider, providing services in the form of purchase and sales according to Art. 3 (c)(1) FinSA . Vanguard Investments Switzerland GmbH will not perform any appropriateness or suitability assessment. Furthermore, Vanguard Investments Switzerland GmbH does not provide any services in the form of advice. Vanguard Funds Series plc has been authorised by the Central Bank of Ireland as a UCITS. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisors on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

Vanguard Funds plc has been approved for offer in Switzerland by the Swiss Financial Market Supervisory Authority. The information provided herein does not constitute an offer of Vanguard Funds plc in Switzerland pursuant to FinSA and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for Vanguard Funds plc. The Representative and the Paying Agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Copies of the Articles of Incorporation, KID, Prospectus, Declaration of Trust, By-Laws, Annual Report and Semiannual Report for these funds can be obtained free of charge from the Swiss Representative or from Vanguard Investments Switzerland GmbH via our website.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

The Indicative Net Asset Value (“iNAV”) for Vanguard’s ETFs is published on Bloomberg or Reuters. Refer to the Portfolio Holdings Policy.

For investors in Ireland domiciled funds, a summary of investor rights can be obtained and is available in English, German, French, Spanish, Dutch and Italian.

Issued by Vanguard Investments Switzerland GmbH.

© 2024 Vanguard Investments Switzerland GmbH. All rights reserved.