Viktor Nossek, Head of Investment & Product Analytics, Vanguard Europe

Many European investors have achieved diversification by investing in funds that track a broad universe - such as the MSCI Europe Index, which is comprised of the shares of large- and mid-sized companies from developed markets in Europe. While that strategy continues to serve investors well, there are a wealth of indices that can give more specific and targeted exposures within the European universe.

There are both similarities and differences in the way European countries have experienced the Covid-19 pandemic and their recoveries out of this unprecedented global event, while sharing common patterns, will also have aspects which are unique to each nation.

Something that stands out at the present time is the success of the UK’s vaccination programme and the implications this has for triggering a bounce back in the UK economy. Economic activity in the UK is fuelled by its service sector to a far greater degree than many other European economies, and this sector was impacted more severely by lockdowns and social distancing measures than many other areas of the economy.

With the UK’s rapid-roll out of its vaccination programme the service sector—which had been hamstrung by the virus—has begun to reopen. Further moves in this direction could continue to provide a tailwind for stocks reliant on domestically focused earnings. Those equities, we believe, may be best represented by the broader market mid-cap index, the FTSE 250.

Although the FTSE 100 is often seen as the barometer of the UK’s economic health, the benchmark is heavily skewed towards multinationals (FTSE 100 companies derive approximately three quarters of their revenues from overseas)1 and the prospects and drivers of those stocks tend to be more closely aligned to global trends. Meanwhile, a lesser proportion of the FTSE 250’s earnings are from overseas (less than 60%) 1 so the relationship with the domestic UK economy is much stronger.

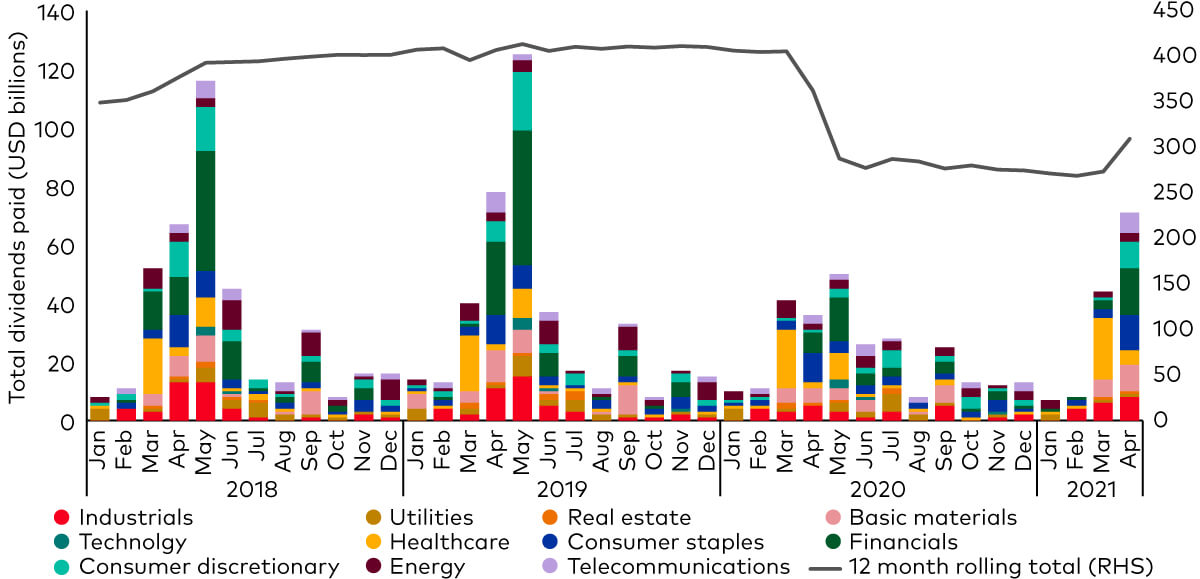

One of the measures that suggests confidence is re-emerging in the real and expected recovery of European economies is dividend payments to shareholders. Many companies had suspended their dividends last year as they sought to shore up their balance sheets and strengthen, as much as possible, their loan/loss provisions. Across much of Europe, dividend payments that had been suspended amid Covid-19 restrictions have resumed and once again picked up the usual pattern of seasonality in their distribution.

The dividend windfall by European companies is typically paid out in the second quarter of the year (approximately 75% of annual dividends are paid out at this time)2 and after last year’s interruptions the outlook for European dividends has stabilised. As economies have begun to open up, investors have become more confident in the ability of European companies to distribute payments.

Dividend payments by European companies

Past performance is not a reliable indicator of future results

Source: Factset. Data as at 30 April 2021. Dividends are in USD.

With the UK currently ahead of many European peers and the US in its vaccination effort, and given the generally greater agility of small-cap companies to bounce back from their relatively deeper retrenchments, they are positioned to outpace the growth of large caps. This should lead to better dividend growth as well.

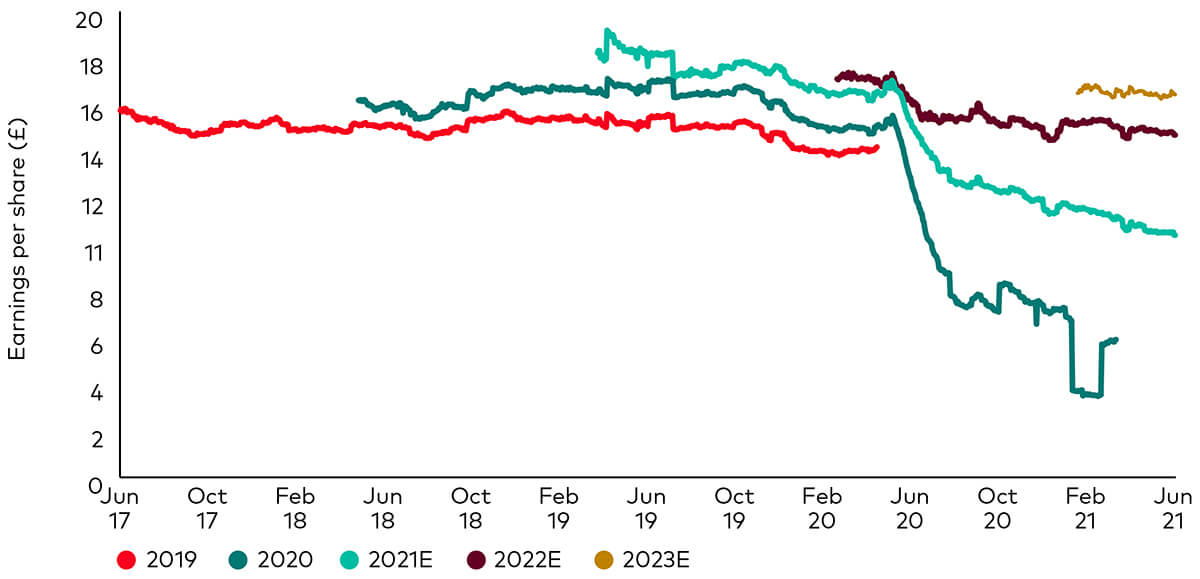

Of course, the price at which any opportunity—in this case investment in the FTSE 250—is accessed is all-important. Looking at the price-to-earnings (P/E) ratio, FTSE 250 companies have already caught up with pre-pandemic levels and some investors may think the best opportunity to invest in this segment of the UK market has been missed. However, data suggests earnings should continue to recover.

The chart below indicates the worst is over following the 2020 earnings slump and that earnings (estimated) should recover in 2021 and 2022 to pre-Covid-19 levels.

Expectations for FTSE 250 earnings per share

Past performance is not a reliable indicator of future results

Source: Factset. Data from 5 June 2017 to 1 June 2021. Earnings per share in GBP. Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

The recovery in the P/E ratio and the premium by which it is trading relative to broader large-cap stocks in the UK is not just based on sentiment - it is justified by the fundamentals that underpin it.

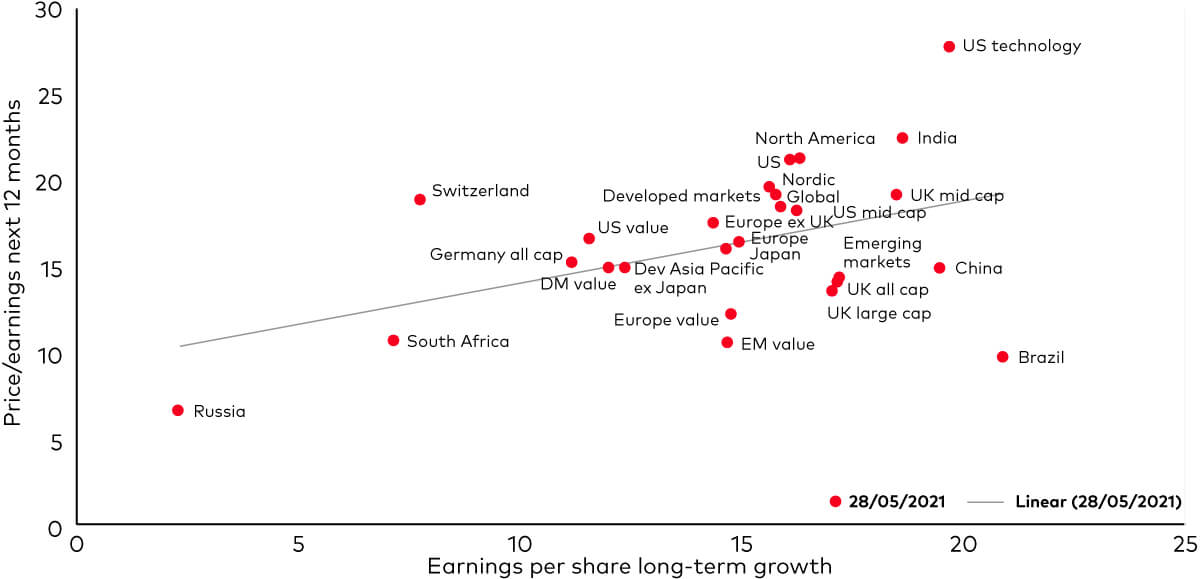

UK mid-caps premium justified by better growth expectations

Source: Factset as at 31 May 2021. Currency local.

Europe as a whole appears to be on the road to recovery out of the pandemic and investing broadly in European equities makes sense. At Vanguard, we believe a sound investment strategy starts with asset allocation. Studies show4 that for diversified portfolios, asset allocation decisions are responsible for the vast majority of a portfolio’s returns over time.

However, it is also worth understanding how different exposures can complement or detract from each other at different points in the economic and market cycle. A Europe ex-UK benchmark, giving value tilted large-cap exposure, could be complemented by an allocation to UK mid-caps that capture domestic UK growth through a FTSE 250 index exposure.

The UK’s lead in vaccination rollout, at the start of 2021, drove momentum in FTSE 250 stocks. Now that argument is moving on and the focus is shifting towards the consideration of valuations versus fundamentals. We believe that this could strategically position the role UK mid-caps could play in an investors’ portfolio beyond Covid-19.

1 Source: Factset. Data as at 31 May 2021. FTSE 100: 77% of earnings derived from overseas, 23% domestic. FTSE 250, 58% of earnings from overseas, 42% domestic.

2 Source: Factset. Data as at 30 April 2021

3 Source: Factset. Data as at 31 May 2021. Currency is local

4 Vanguard’s framework for constructing globally diversified portfolios, May 2021.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the “Risk Factors” section of the prospectus on our website at https://global.vanguard.com.

Important information

This is an advertising document. For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers

on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

Vanguard Funds plc has been authorised by the Central Bank of Ireland as a UCITS and has been registered for public distribution in certain EEA countries and the UK. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisers on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited is a distributor for Vanguard Funds plc.

For further information on the fund's investment policies, please refer to the Key Investor Information Document (“KIIDs”). The KIID for this fund is available in local languages, alongside the prospectus via Vanguard’s website https://global.vanguard.com/.

The Indicative Net Asset Value (“iNAV”) for Vanguard’s ETFs is published on Bloomberg or Reuters. Refer to the Portfolio Holdings Policy at

https://global.vanguard.com/portal/site/portal/ucits-documentation for holdings information.

London Stock Exchange Group companies include FTSE International Limited ("FTSE"), Frank Russell Company ("Russell"), MTS Next Limited ("MTS"), and FTSE TMX Global Debt Capital Markets Inc. ("FTSE TMX"). All rights reserved. "FTSE®", "Russell®", "MTS®", "FTSE TMX®" and "FTSE Russell" and other service marks and trademarks related to the FTSE or Russell indexes are trademarks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and Russell under licence. All information is provided for information purposes only. No responsibility or liability can be accepted by the London Stock Exchange Group companies nor its licensors for any errors or for any loss from use of this publication. Neither the London Stock Exchange Group companies nor any of its licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE or Russell indexes or the fitness or suitability of the indexes for any particular purpose to which they might be put.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities. The prospectus or the Statement of Additional Information contains a more detailed description of the limited relationship MSCI has with Vanguard and any related funds.

For Dutch investors only: The fund(s) referred to in this document are listed in the AFM register as defined in section 1:107 Dutch Financial Supervision Act (Wet op het financieel toezicht).For details of the Risk indicator for each fund listed in this document, please see the fact sheet(s) which are available from Vanguard via our website https://www.vanguard.nl/portal/instl/nl/en/product.html.

For Swiss professional investors: The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Investments Switzerland GmbH is a financial services provider, providing services in the form of purchase and sales according to Art. 3 (c)(1) FinSA. Vanguard Investments Switzerland GmbH will not perform any appropriateness or suitability assessment. Furthermore, Vanguard Investments Switzerland GmbH does not provide any services in the form of advice. Vanguard Funds Series plc has been authorized by the Central Bank of Ireland as a UCITS. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisors on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation. Vanguard Funds plc has been approved for offer in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). The information provided herein does not constitute an offer of Vanguard Funds plc in Switzerland pursuant to FinSA and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for Vanguard Funds plc. The Representative and the Paying Agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Copies of the Articles of Incorporation, KIID, Prospectus, Declaration of Trust, By-Laws, Annual Report and Semiannual Report for these funds can be obtained free of charge from the Swiss Representative or from Vanguard Investments Switzerland GmbH via our website https://global.vanguard.com/.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2021 Vanguard Group (Ireland) Limited. All rights reserved.

© 2021 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2021 Vanguard Asset Management, Limited. All rights reserve

794